Every person carrying on business comes under provisions of Tax audit u/s 44AB of income tax act 1961 with the terms and conditions and threshold limits. If businesses meet the conditions given in section 44AB of the income tax act so their accounts must be audited by a Practicing CA (Chartered Accountant).

Under Section 44AB of the Indian Income Tax Act, objective of a tax audit, according to Section 44AB of the Income Tax Act is to make sure those taxpayers who are subject to audit requirements comply with the Income Tax Act’s rules and truthfully declare their income, deductions, and other financial information for taxation purposes.

The tax auditor examines the taxpayer's books of accounts, records, and documents to make sure they are in accordance with the prescribed accounting standards and methods. The objective is to make sure that the financial statements are reliable and can be used as a basis for computing taxable income.

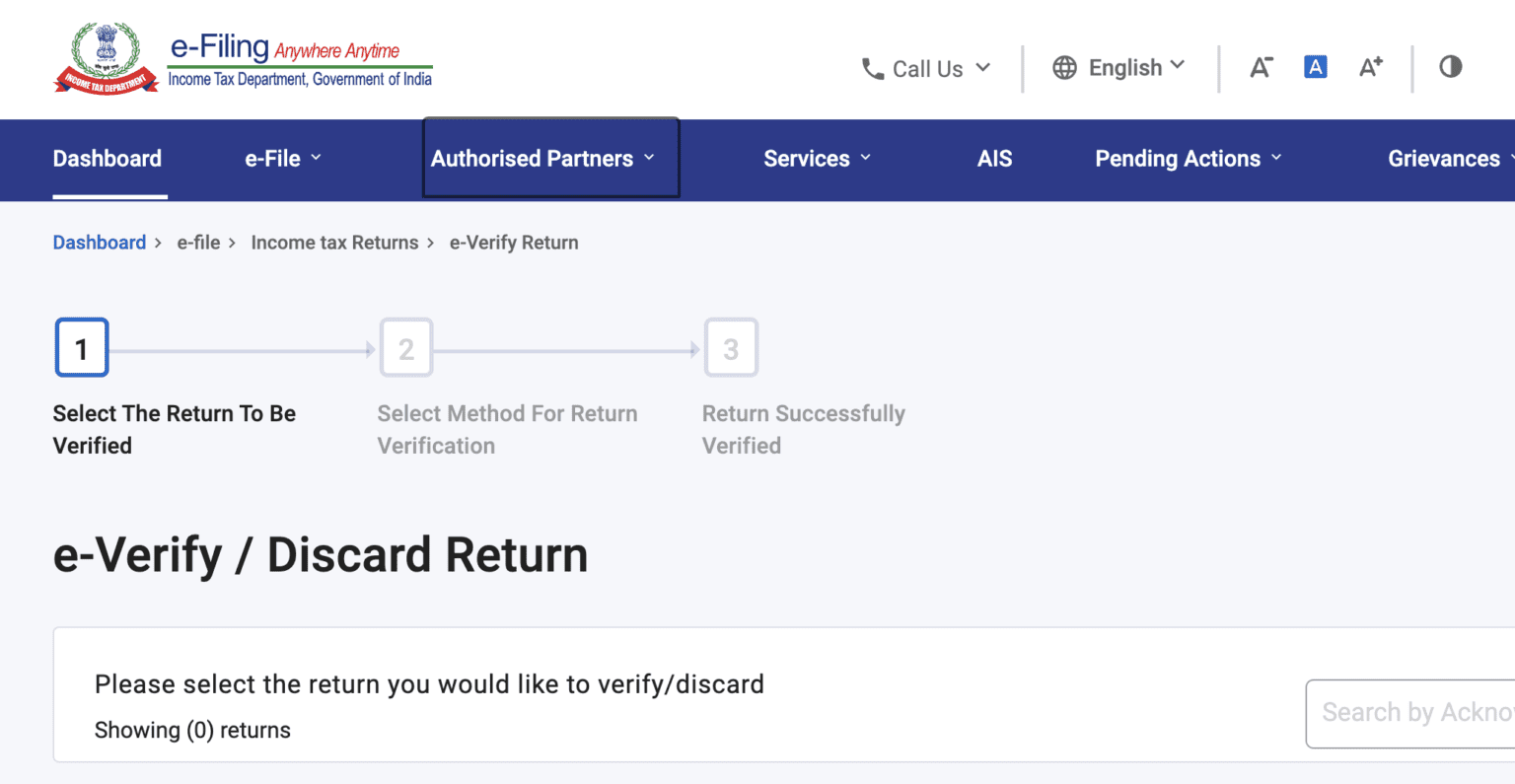

Applicability of Tax Audit u/s 44AB

Tax Audit u/s 44AB is mandatory for certain categories of taxpayer if their annual turnover or gross receipt exceeds the limit specified under section 44AB. The limit for tax audit u/s 44AB is depending on the category of taxpayer.

It is mandatory for all business whose annual turnover /sales/gross receipts exceeds Rs. 5 crores and for those whose annual turnover is less than Rs. 5 crore, but more than Rs. 1 crores but business cash transactions are more than 5 percent of total turnover/receipt in business, then the taxpayer needs to audit their books of account u/s 44AB.

It is mandatory for the professional whose annual gross receipt is more than 50 Lakhs are need to audit their books of account u/s 44AB.

It mandatory for the taxpayers, who are opting presumptive taxation scheme and declaring their income under section 44AD and 44ADA if the taxpayer is showing their profit below the limit prescribed under section 44AD, 44ADA need to get their books of audit audited u/s 44AB.

Limit under Presumptive taxation scheme

44AD:-

44AD is for the small taxpayer whose annual turnover is less than Rs. 2 crore , can take a benefit of presumptive taxation scheme. Under this section, the taxpayer needs to show their profits under prescribed rate i.e. for bank transactions 6 percent of total turnover and for cash transactions 8 percent of total turnover. If the taxpayer is showing their profit below the limit prescribed rate presumptive section 44AD, they need to audit their books of account u/s 44AB.

44ADA:-

Section 44ADA is for the professional whose annual gross receipt is less than 50 lakh, can take a benefit of presumptive taxation scheme. Under section 44ADA, taxpayers need to show their profits under the prescribed rate i.e. 50 percent of total receipt. If the taxpayers are showing their profit below the prescribed rate under section 44ADA, need to audit their books of account u/s 44AB.