New Discard Return under Income Tax active –

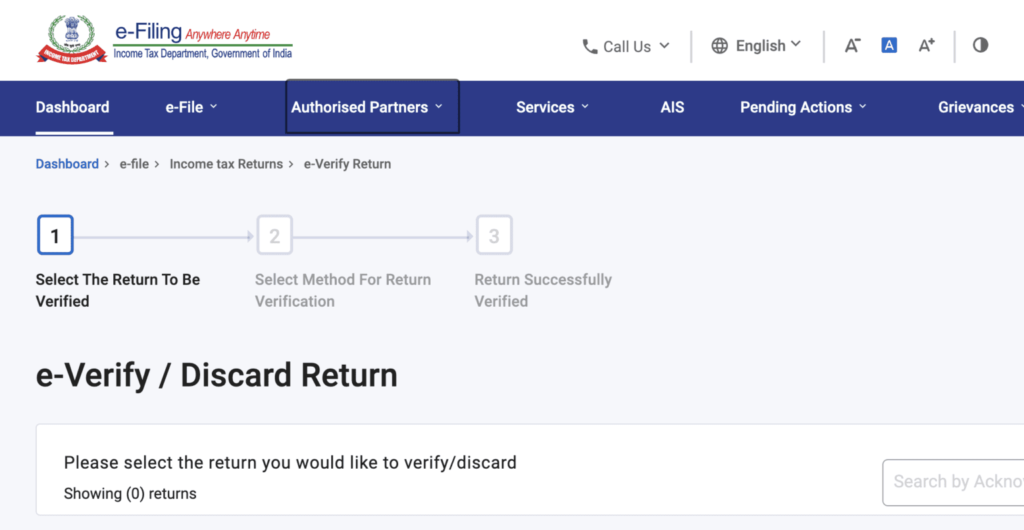

A new return option called “Discard Return” was just added to the Income Tax Portal as of November 27, 2023. It can be found under the Tab E File > Income Tax return > E Verify Return.

Filed Original ITR u/s 139(1) on 30th July 2023 but not yet verified.

For ITRs filed under Sections 139(1), 139(4), and 139(5), users have the option to “Discard” if they do not wish to validate it. After dismissing the prior, unconfirmed ITR, users are given the option to file a new one. On the other hand, if the “ITR filed u/s 139(1)” is discarded and the subsequent return is filed beyond the u/s 139(1) due date, it will result in consequences such as 234F and other late fees. Therefore, before destroying any previously submitted returns, it is advisable to verify whether the deadline for filing the return under section 139(1) is available or not.

Discarded my ITR by-mistake. Is it possible to reverse it?

No, an ITR cannot be reverted once it has been discarded once. When using the Discarding option, please exercise caution. An ITR that is discarded indicates that it was not filed at all.

Find “Discard option”

User can find Discard option in below path : www.incometax.gov.in → Login → e-File → Income Tax Return → e-Verify ITR → “Discard”

If I “Discarded” my previous unconfirmed ITR, do I still need to file a later one?

It is believed that a user who uploaded return data earlier and used the option to dismiss an unverified return will file a second ITR later on since he is expected to file an income return as a result of his earlier action.

My ITR V was sent to CPC, but it hasn’t arrived yet; it’s still in travel. However, because I’ve learned that certain details were not provided accurately, I don’t want to check the ITR. Can I use the “Discard” option still?

When the ITR-V has already been forwarded to CPC, the user is not allowed to delete such returns. Prior to rejecting the return, there is an undertaking to that effect.

Can users avail this “Discard” option multiple times?

Only those with an ITR status of “unverified” or “Pending for verification” are eligible to use this option. It is not prohibited to use this option more than once. The “ITR status” of “Unverified” or “Pending for verification” is a prerequisite.

My ITR filed for AY 2022-23 is pending for verification. Can Users avail this “Discard” option?

This option is available to users only for the corresponding ITR starting in AY 2023–2024. This option is only accessible until the deadline for filing an ITR under sections 139(1), 139(4), and 139(5), which is currently the 31st of December of the relevant AY.

The user wants to file a follow-up ITR on August 22, 2023, having deleted their original ITR 1 from July 30, 2023, on August 21, 2023. Which section ought the user to choose?

In the event that the user discards the original ITR filed under section 139(1), for which the applicable deadline has passed, they must choose section 139(4) when filing a subsequent return. Since there isn’t a previous legitimate return, the Original ITR date and Acknowledgment number fields aren’t relevant. Additionally, the user must supply the “Original filing date” and “Acknowledgement number” of the valid ITR—that is, the ITR filed on August 22, 2023—if he wishes to file a revised return in the future.

Also read: Clarification on how to determine the place of supply under the GST in different scenarios

Also read: Israel-Hamas war makes way for 1 Lakh Indians to replace palestinian workers