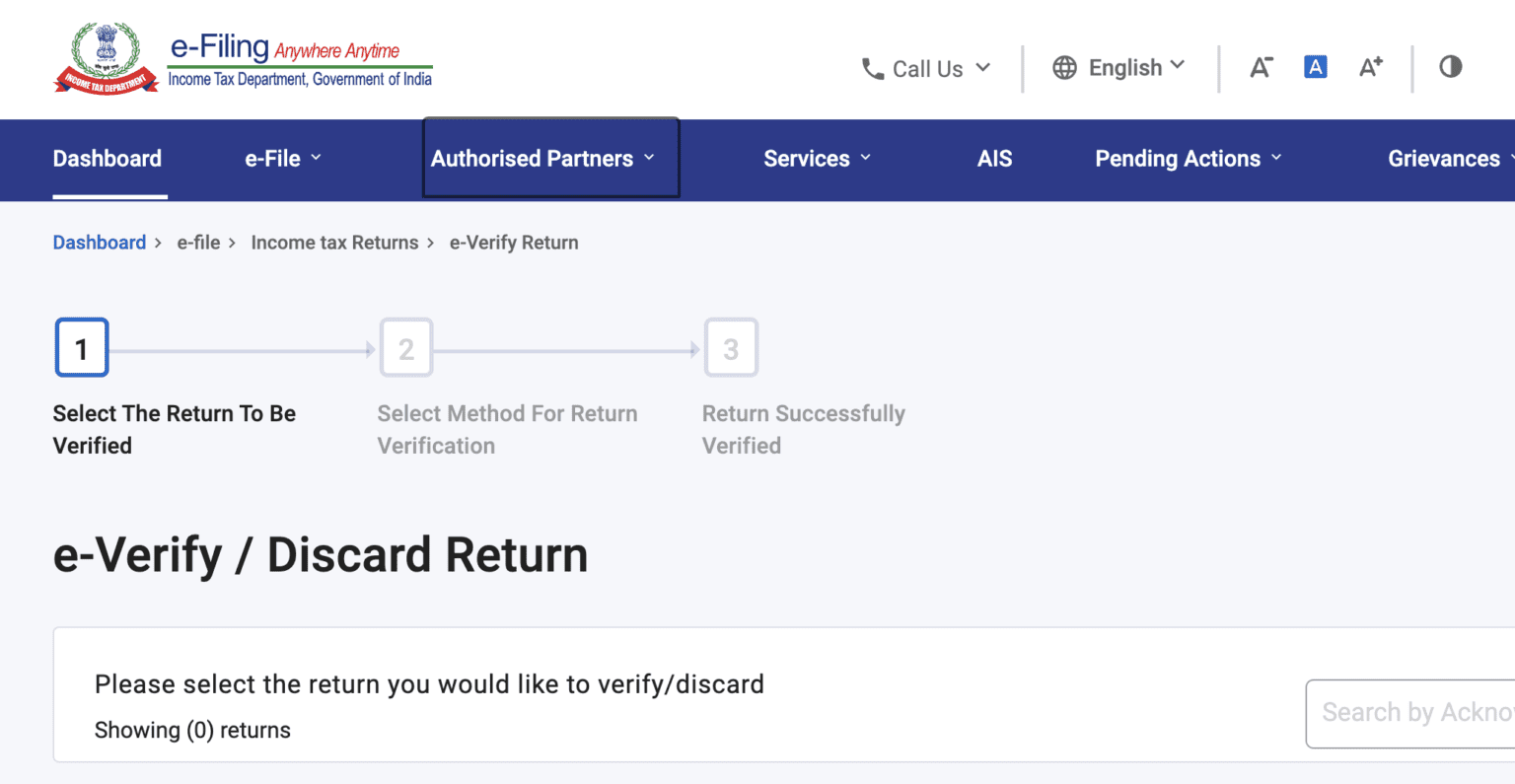

Circular Number 9/2023- Dt: 28th June 2023

The Central Board of Direct Tax (CBDT) has recently extended the due date of filing TDS/TCS return in form 26Q, 27Q and 27EQ through circular 9/2023 dated June 28, 2023 for the first quarter of the financial year 2023-24. Originally it is scheduled to be filed by July 15 or 31 July, 2023 for the first quarter, now after the circular by CBDT dated June, 28, 2023, taxpayers have option until September 30, 2023 to file TDS and TCS return in form 26Q, 27Q and 27EQ.

TDS and TCS Form:

26Q- TDS on all payments other than salary.

27Q: TDS on all payments other than salary to non resident persons.

27EQ: 27EQ is TCS return.

FAQ's

After the circular by CBDT dated June 28, 2023, taxpayers have option until September 30, 2023 to file TDS and TCS return in form 26Q, 27Q and 27EQ.

It is scheduled to be filed by July 15 or 31 July.

TDS on all payments other than salary.

TDS on payment other than salary to non-resident persons.

27EQ is TCS (Tax Collected at source) return.