Updated Advisory: Time limit for Reporting Invoices on the

IRP Portal

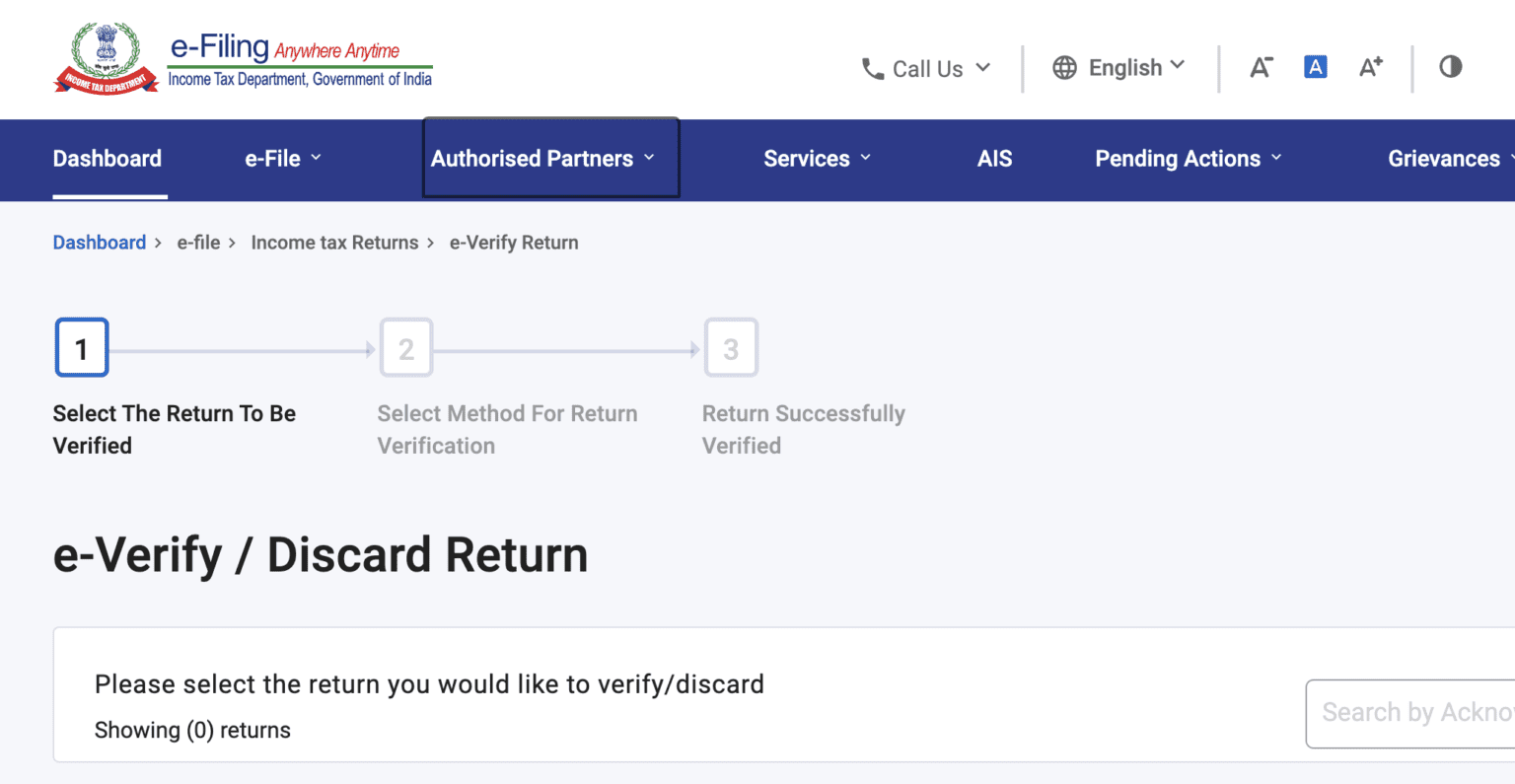

It has been decided by the government to force a time limit for reporting old tax invoices on the E- invoice portal “Invoice registration portal (IRP)” for taxpayers with annual turnover more than 100 crores. It is to ensure timely compliance, or that taxpayers who are falling in this category will not be allowed to report invoices older than 7 days on the date of reporting. This is to note that this restriction will apply to all document types for which e-invoice in “invoice registration portal (IRP)” is to be generated. Therefore, if issued, the credit/ Debit note will also have to be reported within 7 days from issue of the invoice.

This validation system built into the IRP portal will disallow the user to report the invoices after the 7 days, it is important for taxpayers to ensure that they report the invoice within the 7 days window provided updated advisory on new time limit. We recommend starting implementation on May 1, 2023, to provide taxpayers enough time to comply with the requirement, which may require changes to your systems.

FAQ's

That taxpayer who is falling in this category will not be allowed to report invoices older than 7 days on the date of reporting.

Taxpayers having annual turnover more than 100 crores.

It will be implemented from May 1, 2023.