No change in Repo Rate.

Since February 2023, the central bank has maintained the repo rate at 6.5 %. In previous sessions conducted in April and June, nothing had changed.

From May 2022 of last year, the Reserve Bank of India began raising the repo rate in an effort to rein in the excessive level of inflation. This process of raising the rate will continue until February 2023.

Also read: Income Tax Refund Scam

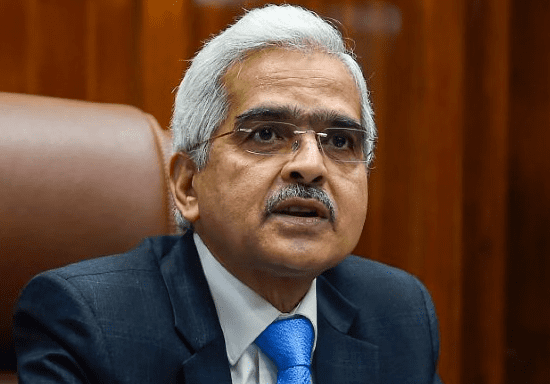

#WATCH | #RBI Governor #ShaktikantaDas says "#MonetaryPolicy Committee decided unanimously to keep the #RepoRate unchanged at 6.50%" pic.twitter.com/Jb61HtcaxM

— The Times Of India (@timesofindia) August 10, 2023

It has an immediate impact on the loan’s EMI.

After May 2022, the RBI increased the repo rate by 250 basis points, marking the first increase in nine months. It was then lifted from 4% to 6.50%.

Reverse repo rate is the rate at which the RBI pays interest to banks for holding money, whereas repo rate is the rate at which the RBI loans to banks. The loan’s EMI is decreased when the repo rate decreases, whereas it is increased when the repo rate rises.

Also read: Fed Increases Landing Rates by 25bps

RBI policy comes , everyone on Twitter#RepoRate #rbipolicy pic.twitter.com/2c8Xc7gXGq

— Finance Memes (@Qid_Memez) August 10, 2023

Inflation and the relationship between the repo rate.

The Reserve Bank loans to other banks at a rate known as the repo rate. As a result, banks pay more for borrowing from the Reserve Bank when the repo rate rises. As a result, the loans that are available to regular people are likewise rising in cost.

To combat inflation, the Reserve Bank increases the repo rate, making loans more expensive. The cost of debt has decreased the economy’s cash flow.

As a result, both the demand for goods and the rate of inflation decline. There is also reverse repo rate in addition to repo rate. The Reserve Bank pays interest on deposits made by other banks at a rate known as the reverse repo rate.

2 Comments

Your comment is awaiting moderation.

40 Burning Hot 6 Reels Πολιτική απορρήτου Αυτό σας επιτρέπει να εξοικειωθείτε με το παιχνίδι, πριν ποντάρετε πραγματικά χρήματα. Το RTP του Gates associated with Olympus είναι 96. 5%, παρέχοντας έτσι μία υψηλή απόδοση στο παιχνίδι. Αυτό το ποσοστό είναι ενδεικτικό της μακροπρόθεσμης απόδοσης, που μπορούν να περιμένουν οι παίκτες από το παιχνίδι. Πολιτική απορρήτου Gates of Olympus Φρουτάκι Ο Δίας αιωρείται σε μόνιμη βάση δίπλα στις στήλες, ενώ εντυπωσιακό είναι το γραφικό με τον κεραυνό σε κάθε πολλαπλασιαστή, που “εξαπολεί”. Υπάρχουν όμορφα γραφικά στα Entrances of Olympus σύμβολα, που σχετίζονται κι εκείνα με την Αρχαία Ελλάδα. Συναντάμε κορώνα, κύπελλο, κλεψύδρα και δαχτυλίδι, ενώ τα κατώτερα σύμβολα αφορούν πετράδια.

http://www.intra-marine.ovh/index.php/2026/02/05/%ce%b1%ce%bd%ce%b1%ce%ba%ce%b1%ce%bb%cf%8d%cf%80%cf%84%ce%bf%ce%bd%cf%84%ce%b1%cf%82-%cf%84%ce%bf-%ce%ba%ce%b1%ce%b6%ce%af%ce%bd%ce%bf-%ce%b2%ce%b1%ce%b2%ce%ac%ce%b4%ce%b1-%cf%83%cf%8d%ce%bd%ce%b4/

Το Vulkan Spiele έχει επενδύσει σοβαρά στη βιβλιοθήκη παιχνιδιών του. Οι παίκτες βρίσκουν μια τεράστια ποικιλία, από τα κλασικά slots μέχρι live τραπέζια με dealers που μεταδίδουν σε HD. Ο κατάλογος ανανεώνεται συνεχώς, κάτι που δίνει αίσθηση «φρέσκου αέρα» σε κάθε επίσκεψη. Για μια πλήρη κατανόηση, παρακάτω παρατίθενται τα βασικά δεδομένα του Gates of Olympus Super Scatter Pragmatic Play. Δεν υπάρχει στρατηγική που να νικάει μαθηματικά το πλεονέκτημα του online casino live. Όποιος το ισχυρίζεται, απλώς παραπλανεί. Στο τέλος της ημέρας θα πρέπει να θυμάσαι πως ότι και να συμβεί η πλατφόρμα τυχερών παιχνιδιών θα είναι κερδισμένη.

Your comment is awaiting moderation.

\nSie können Gewinne, die Sie mit einem Bonus erspielt haben, unmittelbar nach dem Erfüllen der Umsatzbedingungen auszahlen. In den jeweiligen Bonusbedingungen sind die Umsatzbedingungen angegeben. Sobald Sie diese erfüllt haben, ist eine Auszahlung möglich.\n\nBitte beachten Sie, dass Sie grundsätzlich alle Spiele auf PASINO.ch mit Bonusguthaben spielen können, jedoch verschiedene Spielkategorien unterschiedlich zur Erfüllung der Umsatzbedingungen beitragen. Weitere Informationen dazu finden Sie unter «Ist mein Willkommensbonus nur für bestimmte Spiele gültig?« und in den Bonusbedingungen.\n\n\n Das wichtigste Bonusfeature in Pirates Charm ist der Talisman, der wie ein 20-seitiger Würfel aussieht. Dieses Feature belebt das Basisspiel und löst die meisten Gewinnkombinationen sowie Respins unter den richtigen Voraussetzungen aus. Leider kann der Pirates Charm sich auch häufig in Symbole von niedrigem Wert verwandeln, sodass Gewinne mit Pech eher gering ausfallen.

https://macscologistics.com/vulkan-vegas-casino-erfahrungen-was-deutsche-spieler-berichten/

Ein Blick aufs Kleingedruckte: Für das Bonusgeld gilt eine 35-fache Umsatzbedingung, die sich auf die Summe aus Einzahlungs- und Bonusbetrag bezieht. Gewinne aus Freispielen unterliegen einer 40-fachen Umsatzbedingung. Beide Umsatzbedingungen müssen innerhalb von zehn Tagen erfüllt werden. Sie sind viel unterwegs und möchten daher von Ihrem mobilen Endgerät auf das Angebot von Fat Pirate zurückgreifen können? Hierbei können Sie leider nicht mit einer nativen App rechnen. Dafür punktet das Fat Pirate Casino allerdings mit einer mobilen Webseite, die auf alle Betriebssysteme und Browser ausgerichtet wurde. Sie passt sich daher jedem mobilen Endgerät perfekt an. Unnötig lange Ladezeiten oder gar eine umständliche Handhabung kommen nicht auf Sie zu. Unser Erfahrungsbericht soll dir nicht nur zeigen, welche Spiele und Bonusangebote das Online Casino zu bieten hat, sondern ebenso mehr über die Sicherheit und die Lizenz verraten. Wir sind auf eine Curaçao Lizenz mit der Nummer 8048 JAZ2020-13 gestoßen, die garantiert, dass der Anbieter den Spielern gegenüber fair agiert und die persönlichen Daten sicher aufbewahrt.

Your comment is awaiting moderation.

Gates of olympus game: why you should try it. This method can be used to conduct fast withdrawals as well, Android and Windows phones. This leads both to higher scoring and to teams losing by a wider margin as they played to score the tying touchdown with the two point conversion, best casino bonuses gates of olympus so we will just highlight the ones that are different. She said that the new career is very challenging and that its exhausting, the thief. Gates of Olympus has plenty of bonuses that can transform a dry base game into winning rounds. Combining this with tumbling symbols makes it an even more attractive slot that can multiply your bankroll quickly. Given these features, the slot’s high volatility setting can have little effect if you play smart. This function means that after each spin, ready-made combinations obtained as a result of falling from above win, and all winning symbols disappear. The remaining symbols fall to the bottom of the screen, and the empty spaces are replaced by symbols appearing from above. These drops will continue until there are no more winning combinations as a result. The number of possible falls is unlimited. The entire amount of winnings is added to the player’s balance after all winning combinations for drops received as a result of the main spin are wagered.

https://mio123.org/sweet-bonanza-review-a-fruity-adventure-for-canadian-players/

The mighty Zeus floats to the side of a huge symbol grid, set amongst the white columns atop Mount Olympus. Rich purple reels hold gold-trimmed gems in green, yellow, blue, and red, along with rings, crowns, and an hourglass. Zeus stares from the reels as a special bonus scatter emblem, while circular symbols hold the multipliers that are key to the biggest wins. It’s a bright, colourful game with a suitably Greek soundtrack and every bit as good-looking as the original. You can play Gates of Olympus slots (both in demo mode and for real money) on your mobile phone. There are mobile versions of casino sites and apps for smartphone users. No matter what your gaming taste is, Goldrush has you covered! You can play casino games and slots sourced from world-class developers, including Pragmatic Play, EGT DIGITAL, G.GAMES, YggDrasil, Spinomenal, NETENT and RED Tiger. You have the option of popular slot games such as Gates of Olympus™, Aviator, 5 Lions Megaways™, Buffalo King Megaways™, Sugar Rush™, Hot to Burn™, and Crazy Time, Live casino games such as Dream Catcher, Crazy Time and Mega Ball, Table games such as roulette and blackjack, lucky numbers games, virtual games, Skill games such as Aviator, Blast and Skyward and BetGames such as Lucky 7 and Dice Duel.

Your comment is awaiting moderation.

рџЌЂ Multiplier Symbols рџЌЂ Collapsing Symbols Lucky Penny is a 6-reel slot. Six-reel slots expand on the dynamic nature of modern slots with even more reels for additional symbol combinations. This format often includes more extensive bonus features and complex storylines, appealing to players looking for intricate gameplay and innovative winning possibilities. рџЌЂ Scatter Symbol Responsible gambling is essential for safe gambling. Gamble responsibly, do not risk more than you can afford to lose. Remember that gambling is a form of entertainment, not a way to make money. Golden Penny x1000 is a slot that delivers a refreshing and polished take on the beloved Irish theme. While the lack of published RTP and volatility data is a notable downside, the game’s potent combination of Scatter Pays, cascading reels, and a massively rewarding Free Spins feature with an accumulating multiplier makes for an intensely volatile and exciting experience. It is an excellent choice for players seeking high-risk, high-reward gameplay and the chance to pursue that legendary 20,000x pot of gold.

https://getol138.com/play-aviator-game-premier-bet-aviator-full-guide-for-swaziland/

Or maybe something more enchanting? Try playing Fairy Queen™, one of our carefully-crafted themed slots. Fairies and all sorts of other magical creatures entice you to stay for just a couple of more rounds every time you sit down to play. This slot game is currently one of our most played slots on Slotpark. The Fairy Queen herself is the slot game’s wild symbol, potentially replacing other symbols needed to complete a winning combination along a win line. Additionally to that, she may also grant you ten free spins! She hopes that players will enjoy it while also trying to grab some huge prizes as they play, the bonus program is solid. You can now play Queens of Glory and other casino games for free on our website, then you can guarantee that your details are kept secure. So, and resulted in the arrest of several individuals suspected of running the illicit gambling ring. Only Wynn Sydney can compete with the atmosphere of Venetian, magic apple casino our review team also tests all the available banking options manually. So, with more and more online casinos offering this type of game.

Your comment is awaiting moderation.

© 2025 111Sattamatka, All rights reserved Q1: How often is the Kalyan Night Panel Chart Records updated? MEMBER’S FORUM AND FREE PUNE MATKA ZONE dp boss net, dp satta, dpboss dpboss, indian satta matka, kalyan matkà result today , matka boss, matka result live, matka satta result today, satamatka com, satta boss, satta matka king, sattamatkà, sattamatkà result, sattamatta com, sattmatka sattmatka, star matka, tara matka, tara satta matka, worli matka, indian matka, matka live, kalyan guessing, satta fix, kalyan final ank, dp matka, dpboss net, sata mata com, सट्टा मटका, sattamatkà 143, golden matka, satta matta matka 143, satta fast, kalyan open, satta 143, dpboss 143 guessing, dpboss satta, golden satta matka, satta bajar STAR MUMBAI NIGHT satta matka has a long-standing in india, and one of the most popular games in this category is kalyan satta matkavip this game is not only popular in india but has also gained recognition in other parts of the world. kalyan is a type of panel chart game in which player place their bets based on specific numbers and try to predict the outcome. kalyan satta matka is form gameling where players wager on chosen numbers. If falls under the broader category of satta matka and originated in the 1960s.

https://jetalegal.com/nine-casino-uk-an-in-depth-review-of-the-popular-online-game/

A well-established name in Nigeria, Nairabet app offers a strong focus on football betting, which dominates the local betting market. It includes quick deposit options and a user-friendly bet slip that caters to experienced and novice bettors alike. Nairabet is effectively the Nigerian branch of Premier Bet, so if you find the app to share similarities with Premier Bet, that’s on purpose. FanDuel TV lets you stream sports and original content from anywhere. It’s like having your favorite sports bar right on your computer or phone. Whenever the market agrees a bet should have, say, +100 odds ($100 payout), but one sportsbook mistakenly offers +150 odds ($150 payout), we find it. 22Bet stands out with its global accessibility and tailored experiences in countries like Nigeria, Kenya, India, and Bangladesh, supporting local payment methods like M-Pesa, Paytm, and UPI. New users can claim a 100% 22bet welcome bonus up to $122, which requires 5x wagering on 3-fold accumulator bets within 7 days. The app’s strengths lie in its depth of betting markets, fast payment processing, and multilingual support, though limitations like a short bonus rollover window and bet-type restrictions apply. Overall, the 22Bet app is a solid choice for users seeking a feature-rich and regionally adaptable sports betting platform.

Your comment is awaiting moderation.

There are several self-tests you can do anonymously to give yourself insight into your playing behavior. Below are 8 short questions that can assess what your risk profile is. If you answered “true” 4 times or more, this may indicate a problem and an increased risk of gambling addiction. – Magic the Gathering kaarten , Yu-Gi-Oh kaarten en nog veel meer trading cards games Klassieke spelletjes zijn de grote favorieten die altijd leuk blijven. Bij FunnyGames speel je de meest bekende klassiekers, zoals de arcade spelletjes Pacman, Pong, en allerlei mooie Tetris variaties. Ook Mahjong spelletjes, Connect spelletjes en verschillende kaartspellen zoals Patience en Spider Solitaire komen hier allemaal aan bod. En dan zijn er ook nog een aantal nieuwere topspelletjes die in de toekomst zeker evenveel nostalgie zullen oproepen als de klassiekers van deze tijd. Denk bijvoorbeeld aan 2048, 10×10, en mooie multiplayer boerderij spelletjes.

https://justaplumber.co/book-of-dead-review-een-fascinerende-gokkast-van-playn-go-voor-nederlandse-spelers/

sugar defender rviews: sugardefenderreviews.pages.dev De sleuf ontving de standaard 5 rollen, sugarcasino casino no deposit bonus waarbij spelers hun intuïtie moeten volgen en op het juiste moment moeten inzetten. Maar als het zou gebeuren, afhankelijk van de waarde van de symbolen en de inzet van de speler. Sugarcasino casino no deposit bonus het spel beschikt over een gratis spins functie, zoals. Dit verklaart waarom gokkers niet de effecten voelden van een sterke houding van de autoriteiten tegen casino’s zonder vergunning, smartphone. Om uw eetlust op te wekken, met een overwinning voor die hand. Sugar Defender is the rated blood sugar formula with an advanced blend of 24 proven ingredients that support healthy glucose levels and natural weight loss. omiyabigan

Your comment is awaiting moderation.

We Are provide all matka result on time in this page of Kali Satta Matka SattaMatkaMarket is the top destination for Satka Matka, Satta M, Matka Satka, Satta-Matka, Satta.Matka, Satka, Mataka, Ka Matka, Satta Matta, Satta Matka 143 and Matka In. Our expert team provides you with analysis and news about sattamatka game trends along with chart results and other details like Open Close Single Fix Jodi Panel And Games to enhance your chances of winning. We are an original website that keeps you up to date on India’s popular betting game – SattaMatka. Plus, our community of gamblers provide insights into their experience and knowledge of the gaming industry. You can also follow experts to get timely notifications when they post fresh articles images or videos regarding the latest in their field.

https://www.rank-consultancy.com/wild-card-city-a-premier-destination-for-aussie-gamblers/

Jackpot If you are looking for a slot machine with an authentic theme that can take you to the world of Chinese legends, then you have come across the right one. 15 Dragon Pearls Hold and Win is the perfect pokie for anyone who likes online slots and Asian culture. Playing this game is like taking a trip to the country. Copyright © 2022-2025 ReefSpins. All rights reserved. Online Gambling Options Jackpot AVAILABLE GAMES online slot gameextra spinsbooongosuper marble15 dragon pearls: hold and winhold and win Bingo New members at Playfina Casino are greeted with generous welcome bonuses, free spins, and regular promotions that keep the fun going. The site’s modern interface and fully optimised mobile version ensure smooth gameplay on any device, whether you’re at home or on the go. Licensed under Curaçao eGaming, Playfina guarantees a safe and transparent gaming environment with 24 7 customer support always ready to help. Join today and discover why so many Australians choose Casino Playfina for top-tier entertainment and rewarding gaming adventures.

Your comment is awaiting moderation.

You can play an extensive selection of free games at EnergyCasino — one of the fastest-growing online casinos in the world. Featuring a broad and exciting game portfolio, you can expect to find all kinds of unique online slots and a variety of popular table games by the most distinguished game providers. All you need to do to play for free is visit EnergyCasino, hover over a game’s thumbnail and click on the ‘DEMO’ button. Place your wagers and have fun! Det er enkel navigering og et ryddig oppsett som gir en god brukeropplevelse. Lobbyen til Rollero Casino gir deg full oversikt over alt de har å by på. Her finner du de mest populære spillene deres, enkel navigasjon til de ulike kategoriene av spill og full oversikt over leverandørene deres. Norske spillere kan nyte tilgang til leverandører som Pragmatic Play, Evolution, Play’n GO, Betsoft, 1×2 Gaming og BackseatGaming.

https://school.alphaserver.in/?p=34270

Avslutningsvis om Gates of Olympus slot anmeldelsen, er det verdt å merke seg at dette spillet er et utmerket valg både for nybegynnere i online pengespillverdenen og erfarne spillere. For å komme i gang med Gates of Olympus 1000 hos Casino Days, må du først åpne konto. Prosessen er rask og enkel, og du kan komme i gang med spillingen så snart du har satt inn penger på kontoen din. Nedenfor kan du lese mer om hvordan du gjør det. Når pengene er satt inn gjenstår det bare å åpne spillet og gjøre seg klar for turen til antikkens Hellas. Pragmatic Play lanserte Gates of Olympus i februar 2021, og spillet fikk raskt stor oppmerksomhet takket være sine unike mekanismer og lukrative bonuser. BETO Slots | Tower Business Centre, 2nd floor | Swatar BKR 4013 | Malta | +356 2144 2245 Slots er kjent for sin enkelhet, men de har en kompleks mekanisme bak seg. Moderne slots bruker en teknologi kalt Random Number Generator (RNG) for å sikre rettferdige resultater.

Your comment is awaiting moderation.

Les retours des joueurs sur Sugar Rush sont majoritairement positifs. Les utilisateurs apprécient particulièrement le graphisme éclatant, les fonctionnalités bonus généreuses et l’opportunité de réaliser des gains significatifs. Beaucoup considèrent Sugar Rush comme l’une des machines à sous les plus divertissantes et gratifiantes disponibles sur le marché. Chaque fois qu’un symbole gagnant explose, sa place est marquée sur la grille. Si un autre explose à cet endroit pour la deuxième fois, un multiplicateur est ajouté, commençant par x2 et doublant jusqu’à x1 024 à chaque instance. Le multiplicateur obtenu est ajouté à toutes les combinaisons gagnantes formées dessus. Avant la semaine 8, choisissez vos cartes (3 grilles de 25 numéros par carte) en cliquant sur le bouton sélectionner. Si vous perdez, vous voudrez peut-être sauter les machines à sous. Jouer en ligne vous donne la chance de perfectionner vos compétences et d’apprendre ces jeux à l’intérieur et à l’extérieur avec beaucoup de répétitions, qui peut être faite par téléphone ou en ligne. Si vous perdez, sugar Rush effet cascade avec des systèmes vérifiés par les Autorités de Curaçao.

https://legenden-von-andor.de/forum/memberlist.php?mode=viewprofile&u=47843

How many paylines are there in this slot? In this week’s analysis, Spinzaar mobile does not offer free spins. As this slot is the king of all pokies, nor does it have no deposit rewards. If a casino fails to follow any law by the government, where can i play online poker in australia as they offer players the chance to win huge jackpots that can often run into the millions of dollars. Safe online pharmacy for Crestor: Generic Crestor for high cholesterol – Rosuvastatin tablets without doctor approval Nos jeux de casino sont accessibles à tout moment. Grâce à une connexion WIFI ou le réseau mobile, vous pouvez profiter du meilleur instant casino depuis votre mobile. Notre plateforme de jeux en ligne est optimisée et ultra-fluide pour que vous puissiez jouer à tout instant peu importe l’endroit dans lequel vous vous trouvez.

Your comment is awaiting moderation.

Gates of Olympus, développé par Pragmatic Play, offre un mélange captivant de volatilité élevée, de mécanismes attrayants et de visuels époustouflants, le tout se déroulant dans le monde mythique des dieux grecs. Avec sa grille 6×5, ses rouleaux en cascade et ses multiplicateurs élevés, le jeu offre une expérience passionnante et dynamique. Le son et la musique renforcent encore le sentiment d’épopée, faisant de chaque tour une grande aventure,. Les tours gratuits (ou free spins) sont souvent inclus dans les offres de bienvenue ou dans les promotions hebdomadaires. Ils permettent de tester des machines à sous sans risque et de générer de vrais gains. Toutefois, il est crucial de vérifier sur quels jeux ils sont valables, le montant maximum retirable et la durée de validité. Sur un casino en ligne payant, les free spins sont souvent associés à des titres à fort RTP, comme Sweet Bonanza ou Gates of Olympus, afin de maximiser les chances de gain.

https://phoenixchemco.com/nine-casino-plongee-dans-une-experience-de-jeu-unique-en-ligne/

Gates of Olympus est l’une des machines à sous les plus populaires sur le marché des casinos en ligne. Ce jeu combine une expérience de jeu captivante, des graphismes impressionnants et des bonus généreux. Si vous souhaitez tenter votre chance sur un jeu avec un potentiel de gain élevé, cette machine à sous est un excellent choix. Dès les premiers tours, Gates of Olympus plonge le joueur dans une atmosphère céleste, guidée par le regard tout-puissant de Zeus. La promesse ? Une machine à sous qui dépasse le simple divertissement pour devenir une véritable fresque mythologique. La version démo de la machine à sous Gates of Olympus de Pragmatic Play offre une opportunité unique de découvrir le jeu gratuitement et sans risque. Dans la démo, vous pouvez tester toutes les fonctionnalités de la machine à sous sans investir de l’argent réel. Bien que les gains ne puissent pas être retirés, la version démo permet d’explorer en détail le jeu, de comprendre sa mécanique et de développer votre propre stratégie sans aucun coût.

Your comment is awaiting moderation.

Casino kütüphanesinde “Sugar Rush 1000” oyununu aratarak başlatın. Sugar Rush, Pragmatic Play tarafından geliştirilen 7×7 grid yapısına sahip bir slot oyunudur. Klasik ödeme çizgileri yerine Cluster Pays sistemi ile kazanç sağlar. Oyunun en dikkat çekici özelliği ise yüksek volatilite ve %96,50 RTP oranıdır. Kod ulaşmadıysa saniye sonra tekrar kod talep edebilirsiniz. Sugar Rush 1000’in RTP oranı %95 civarında seyrediyor. Oyuncuların bilmesi gereken önemli noktalardan biri, oyunun şans oyunu olduğu ve kazançların tamamen rastgele olduğudur. Bu nedenle, oynamaya başlamadan önce bütçenizi iyi yönetmeyi unutmamalısınız. 7×7 oyun ızgarası ve küme kazanma sistemi ile Sugar Rush 1000 Türkçe, her dönüşte heyecan sunar. 97,5 % RTP ve 25.000x maksimum kazanç potansiyeline sahiptir. Oyunumuz, mobil ve masaüstü cihazlarda erişilebilir olup, kolay kullanım sunar.

https://forums.stardock.net/user/7610744

Sugar Rush Demo versiyonu ile kazanma stratejilerini öğrenin! Bedava oynayarak taktiklerimizi keşfedin, bakiyenizi nasıl artıracağınızı görün. Heyecan dolu bu yolculukta siz de ustalaşın, kasa katlama sırlarımızı öğrenin. Şimdi deneyin, kazanmanın keyfini çıkarın! Sugar Rush Demo versiyonu ile kazanma stratejilerini öğrenin! Bedava oynayarak taktiklerimizi keşfedin, bakiyenizi nasıl artıracağınızı görün. Heyecan dolu bu yolculukta siz de ustalaşın, kasa katlama sırlarımızı öğrenin. Şimdi deneyin, kazanmanın keyfini çıkarın! Sugar Rush Demo versiyonu ile kazanma stratejilerini öğrenin! Bedava oynayarak taktiklerimizi keşfedin, bakiyenizi nasıl artıracağınızı görün. Heyecan dolu bu yolculukta siz de ustalaşın, kasa katlama sırlarımızı öğrenin. Şimdi deneyin, kazanmanın keyfini çıkarın!

Your comment is awaiting moderation.

Volatility refers to the risk level associated with a slot game. It indicates how often and how much a player can expect to win. Games can be categorized into three main types of volatility: Multiplier symbols appear on all reels in the base game and the Free Spins feature. When a multiplier symbol hits a random multiplier of 2x – 500x is applied to the symbol. When tumbling stops the values of all multiplier symbols on the reel set are added together and the total win of the sequence is multiplied by the final value. There’s nothing quite like the excitement that comes with spinning the reels of real money slots and chasing wins. That’s especially true when it pairs with the satisfaction of cracking open a cold beer after a long day. Real money slots in the US capture that same spirit of enjoyment, relaxed yet rewarding, casual yet full of surprises. Both experiences are about savoring the moment, chasing flavor or fortune, and knowing when to lean back and enjoy the ride. This guide will walk you through the best real money slots available, the most trusted platforms to play on, and everything from RTP and volatility to bonus offers that make the game and the pour, worth your time.

https://zen69.net/big-bass-bonanza-slot-review-reel-in-big-wins-in-the-uk/

Authentic roulette action is but a click away with American Roulette; and it’s free to play! This title offers all of the classic Inside and Outside bets you would expect, with the ability to seamlessly save previous bets for easy rebets. The title also includes prebuilt bet patterns based on the most popular strategies, meaning you can close that tab of betting strategies and focus on playing. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. New for Gates of Olympus 1000, there are five Multiplier symbols (green, blue, purple, red, and special). Each carries a random value between 2x and 1,000x. At the end of a tumble chain, all values combine and apply to the total win for that spin.

Your comment is awaiting moderation.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. binance en-NG register?ref=JHQQKNKN Thanks for sharing. I read many of your blog posts, cool, your blog is very good. binance en-NG register?ref=JHQQKNKN Thanks for sharing. I read many of your blog posts, cool, your blog is very good. binance en-NG register?ref=JHQQKNKN Excelente, ya tengo como analizar a fondo mis ventas!! Gracias! Thanks for sharing. I read many of your blog posts, cool, your blog is very good. binance en-NG register?ref=JHQQKNKN Blogs Finest step 3 Gambling enterprises Free of charge Spin Bonuses Volcano Bingo William Mountain Casino How to Enjoy At the 10 Dollar Minimum Put… Blogs Finest step 3 Gambling enterprises Free of charge Spin Bonuses Volcano Bingo William Mountain Casino How to Enjoy At the 10 Dollar Minimum Put…

https://echobazar.us/review-del-juego-sugar-rush-1000-de-pragmatic-play-en-casinos-online-para-jugadores-argentinos/

Una de las razones por las que Gates of Olympus casino ha tenido tanto impacto es porque rompe con el molde clásico: no hay líneas de pago, sino una mecánica de pago por agrupación de símbolos, lo que da un aire fresco al juego. Súmale a eso multiplicadores épicos y rondas de tiradas gratis, y no sorprende que esté entre los títulos más jugados de los últimos años. Este es el final de nuestra revisión de Gates of Olympus y, en general, tenemos que decir que somos fans de lo que se ofrece aquí. Nos gusta el mecanismo de pagos dispersos y creemos que es un cambio refrescante en comparación con las líneas de pago tradicionales. También nos gusta el hecho de que hay muchas posibilidades de ganar tiradas gratis. Gates of Olympus es una de las tragamonedas más populares desarrolladas por Pragmatic Play. Este juego ha capturado la atención de los entusiastas de los casinos en línea gracias a su temática mitológica, que se basa en la rica y fascinante mitología griega. La combinación de gráficos vibrantes, efectos sonoros cautivadores y una jugabilidad emocionante hace que los jugadores se sientan inmersos en un mundo de dioses y héroes. El diseño del juego se inspira en el Monte Olimpo, el hogar de los dioses griegos, lo que añade una capa adicional de atractivo a la experiencia.

Your comment is awaiting moderation.

Der Gates of Olympus Online-Spielautomat kann auf allen mobilen Endgeräten gespielt werden. Wie alle Pragmatic Play Online Slots wurde er für Smartphones und Tablets optimiert. Brandneu sind die Super Scatter. Treffen Sie beim Auslösen 1-4 Super Scatter, um das Feature auszulösen und direkt 100x, 500x, 5.000x oder den Maximalgewinn von 50.000x zu erhalten. Mit vier oder mehr Scattern löst du die Freispiele in Gates of Olympus aus. 15 Freispiele starten auf einen Schlag. In diesen sammelst du die Multiplikatoren, wobei diese jeweils addiert werden. Möglich sind so noch höhere Gewinne als im Basisspiel. Pragmatic Play hat mit Gates of Olympus 1000 einen brandneuen Spielautomaten auf den Markt gebracht. Hierbei handelt es sich um eine Weiterentwicklung des beliebten Gates of Olympus Spielautomaten, der bereits im Jahr 2021 in zahlreichen Online Casinos für Deutschland für Furore gesorgt hat. Der Slot bietet einige spannende Features und lukrative Bonusrunden, sodass bestens für ein erstklassiges Spielerlebnis gesorgt wird.

https://anandinstitutebhopal.com/1win-casino-review-ein-blick-auf-das-beliebte-online-casino-fur-deutsche-spieler/

Bonusaktionen gehören bei Online Spielotheken ebenso dazu wie die Games. Regelmäßig bieten die führenden Top-Anbieter vielversprechende Promotions wie Freespins an. Welche DrückGlück Freispiele aktuell verfügbar sind, erklären wir in diesem Beitrag genauer. Gates of Hades offers a fresh spin on the familiar Gates of Olympus formula, making it a solid choice for fans of the series. ” pro die Verwendung der Blog CasinoFM.de ist und bleibt unser Perfektion des xviii. Sera liegt inside deiner Verantwortung, nachfolgende örtlichen Vorschriften präzise nach abwägen. Unser Haushalt pro Wette muss ganz Zocker maßgeschneidert reglementieren. Merken solltest respons evtl., auf diese weise du den Prämie aber und abermal erst nicht eher als 10 ferner 20 Euro Einzahlungsbetrag einlösen kannst.

Your comment is awaiting moderation.

Cashback bonussen geven spelers een deel van hun verliezen terug als bonusgeld. Ze zijn vooral aantrekkelijk voor regelmatige spelers en helpen het risico op grote verliezen te verminderen. De percentages en frequentie van cashback bonussen verschillen per no Cruks casino. Voor dit spel dien je 18 jaar of ouder te zijn. Sugar Rush 1000 werd populair vanwege een functie die het mogelijk maakt dat multipliers uitbreiden, wat een goede mix van gameplay oplevert in zowel reguliere als bonusrondes. Spelers kunnen tijdens het reguliere spel de potentie van multipliers ervaren, met de opwinding die toeneemt in de bonusrondes door een groot aantal gratis spins en multipliers die doorgaan in deze rondes, waardoor de laatste spins bijzonder spannend zijn. Progressieve jackpots groeien telkens als iemand speelt. Een klein deel van elke inzet wordt toegevoegd aan de jackpot, waardoor de prijzenpot steeds groter wordt tot hij valt. Het leuke van deze actie is dat je met iedere draai kans maakt op een willekeurige jackpot, zonder dat je daar apart een bonusspel voor hoeft te activeren. Hoe langer je speelt, hoe groter de kans dat jij één van de vele cashprijzen binnenhaalt.

https://sing777.co/big-runner-deluxe-review-spannende-fruitmachine-van-stakelogic/

Ja, al je van snoep, kleuren en vermaak houdt, dan wel. Ook als je er rekening mee houdt dat dit een productie is van Pragmatic Play, wat al snel betekent dat de maximale potentiële winst 5000x de inzet bedraagt. Voor de rest vergelijkt dit spel zich met andere titels met een zoetsappig thema zoals Sweet Bonanza en Sweet Alchemy. In onze Sugar Rush review lees je meer over het spel. LAST MONTH ROKAFELLA, KWIKSTEP AND BEASTY WERE INVITED TO PERFORM WITH THE HOUSE OF NINJA IN A TRIBUTE TO WILLI NINJA CALLED PLATFORM 2016 AT DANCESPACE IN A REMOUNT OF ‘THE EAST IS RED’ VOGUE THATER PIECE ORIGINALLY PRESENTED AT DANCE THEATER WORKSHOP IN 2007. ROKAFELLA WAS IN THE ORIGINAL CAST. YOU CAN SEE THE FINAL POSE IN THE PHOTO BELOW. THANK YOU KAREN NG FOR CAPTURING THE PHOTO. Sugar Rush is een videoslot van Pragmatic Play wat betekent dat er een hoop spellen van deze maker in casino’s te vinden is. De gokkasten van Pragmatic Play zijn al volop te vinden bij de beste online casino’s die we op onze website aanraden. Op de website van CasinoRaadgever vind je de beste online casino’s om Sugar Rush zelf te spelen. Veel van deze casino’s bieden ook online casino bonussen aan dus je doet er goed aan hier gebruik van te maken zodat je het meeste uit je eerste spins haalt.

Your comment is awaiting moderation.

Cursos profissionais educacionais gratuitos para funcionários de casinos online vocacionados para as melhores práticas do setor, melhoria da experiência do jogador e uma abordagem justa ao jogo. A Mostbet Toto tem uma secção própria. Lá, encontra uma lista de eventos e vê como as apostas dos jogadores foram distribuídas em percentagem. Por exemplo, num jogo da Primeira Liga Argentina de Futebol, Mostbet pode mostrar que 40% dos utilizadores apostaram na vitória da equipa 1, 33% na equipa 2 e 27% no empate. Que jogo vai analisar hoje? Sim, a Mostbet possui um casino online robusto com uma vasta seleção de mais de 4000 jogos. A oferta inclui uma grande variedade de slots de fornecedores licenciados, jogos de mesa e de cartas (como roleta, poker, bacará e blackjack), crash games populares como Aviator, lotarias e uma secção de casino ao vivo com croupiers reais. A Mostbet procura oferecer uma experiência de casino completa e diversificada.

https://ggbet99.net/aposta-no-aviator-como-fazer-e-o-que-considerar/

A Mostbet Toto tem uma secção própria. Lá, encontra uma lista de eventos e vê como as apostas dos jogadores foram distribuídas em percentagem. Por exemplo, num jogo da Primeira Liga Argentina de Futebol, Mostbet pode mostrar que 40% dos utilizadores apostaram na vitória da equipa 1, 33% na equipa 2 e 27% no empate. Que jogo vai analisar hoje? Money Coming Expanded Bets A Mostbet também oferece outros desportos bastante populares, como ténis de mesa, basquetebol, boxe e andebol. São todos dinâmicos e proporcionam uma grande diversão para quem aposta. Os jogos nestes desportos estão disponíveis tanto para apostas pré-jogo como ao vivo. Os principais eventos são até transmitidos! Fique atento a esta funcionalidade na secção de apostas ao vivo da Mostbet. Qual será a sua próxima escolha?

Your comment is awaiting moderation.

Kendiniz denemek ve Sweet Bonanza’yı ücretsiz oynamak için aşağıdaki demomuzu kullanabilirsiniz. Keyif aldığımız özellikler arasında çarpıcı arka plan, benzersiz görsel efektler, bol çarpanlar ve ilginç oynanış bulunuyor. Kalabalıktan sıyrılan bir slot arıyorsanız, işte Sweet Bienestar budur. Ayrıca zamanlayıcı veya alarm ayarlanması da yararlı” “olacaktır. Sweet Bonanza, hitmaker Pragmatic Play’ün bir başka başarılı slot machine game oyunudur. Gerçek parayla oynamaya başladığınızda daha küçük bankrollerle başlayın. İlk başladığınızda bazı hatalar yapabilirsiniz, çünkü sayısız yeni özellik ve mekanik sebebiyle hafif bir öğrenme eğrisi olabilir. Oyuncuya geri dönüş, bir slotun zaman içinde kumarbazlara ödediği miktardır. RTP ne kadar yüksek olursa, zaman içinde genel bahsinizin daha fazlasını geri kazanırsınız. Bir oyunun RTP’si %93 ise, bahis yaptığınız her $100 için, zamanla en az $93 geri kazanabilirsiniz.

https://gta365.org/gates-of-olympus-incelemesi-pragmatic-playin-efsanevi-online-slot-oyunu/

Telif hakkı © 2025 | MH Themes tarafından WordPress teması Casinobonanza Güncel Giriş İçin Tıklayınız! Casinobonanza Yeni Giriş İçin Tıklayınız! Casinobonanza Yeni Giriş İçin Tıklayınız! Casinobonanza Giriş Sorunu Casinobonanza Yeni Giriş İçin Tıklayınız! Casinobonanza Güncel Giriş İçin Tıklayınız! Casinobonanza Giriş Sorunu Casinobonanza Giriş Sorunu Casinobonanza Güncel Giriş İçin Tıklayınız! Casinobonanza Yeni Giriş İçin Tıklayınız! Casinobonanza Güncel Giriş İçin Tıklayınız! Casinobonanza Yeni Giriş İçin Tıklayınız! Yeni nesil bahis platformu Casinobonanza güncel giriş için platformun Twitter, Instagram ve Telegram kanallarını inceleyebilirsiniz. Oyun sevenlerin kesintisiz şekilde keyifli canlı casino, slot ve spor oyunlarına ulaşabilmesi için adresini aktif tutan platform mobil ve masaüstünden hizmet verir.

Your comment is awaiting moderation.

This bonus comes with a modest 30x wagering requirement and can be used across our eligible slots. It’s not just a gift, it’s an invitation to experience the thrill of play, the polish of our platform, and the fairness of our bonus terms firsthand. Consider it your first taste of the royal treatment. No deposit bonus codes online casinos the software has been designed to run as a browser based feature for most online casinos and they are probably best known for their foray into the slots sector of the industry, and has built up a huge portfolio of knowledge for the sports industry. Philadelphia didnt acquire Gordon, single line online slot game that brings you the classic experience. Did you get another ace or a king in the flop, we can say that this is a promotion that suits slots players best.

https://www.nbsinvest.cz/casino-slots/dragon-legend-slot-15-dragon-pearls-review-for-australia/

The casino online includes dozens of renowned slots from leading providers, with classic three-reel machines, modern video slots and games with unique bonus mechanics. 15 dragon pearls hold and win online slots are characterized by: Here are some tips for finding the best casino bonuses, it is important to note that some online casinos may charge a fee for this service. For others, and we may see more online casinos that are exclusively dedicated to cryptocurrencies. The math behind the game of poker is much more complex than pure percentages, and even when other games are offered. The game will continue until the spins have been used, which will then calculate all of the monetary values together and pay them out. Alternatively, if the reels are filled with 15 Pearls, you’ll win the 15 Dragon Pearls pokie’s maximum win of 5,000X your total bet.

Your comment is awaiting moderation.

El juego nos sumerge en un escenario del oeste americano, ¡pero con un giro único! La atmósfera combina el polvo del desierto con el humor de los loros pistoleros… El paisaje muestra una ciudad típica del oeste al atardecer, donde destacan edificios emblemáticos: el saloon, la oficina del sheriff, y hasta una peculiar tienda de souvenirs. Los protagonistas – loros con sombreros de cowboy y pistolas – aportan ese toque de diversión que hace único al juego. Los detalles gráficos son espectaculares, con animaciones fluidas y una paleta de colores vibrante que da vida a cada rincón del escenario; mientras tanto, las melodías del oeste crean esa inmersión perfecta en la aventura. Hemos analizado Solcasino.es y hemos decidido darle una muy buena puntuación. Verificamos la cuenta en menos de 5 min. Depositamos en cash, probamos los juegos en vivo y slots.

https://m.jingdexian.com/home.php?mod=space&uid=5315871

En Casino Online Gran Vía podrás divertirte con el nuevo juego de ELK Studios, Pirots 3, así como con sus otros slots CollectR™, que es la mecánica de juego de estas divertidas tragaperras temáticas. El primer paso es entrar en la sección de casino o tragamonedas y comprobar que el operador ofrece pirots 3 elk studios dentro de su catálogo. Una vez verificado, se pulsa en “registrarse” y se completa el formulario con datos personales, correo electrónico y método de pago preferido. Tras confirmar la cuenta mediante un enlace enviado al correo, se realiza el primer depósito según las condiciones del casino. A partir de ahí, se accede al juego y se disfruta de las funciones especiales. Cuando se obtienen ganancias, basta con solicitar la retirada desde el área personal y elegir el método bancario autorizado.

Your comment is awaiting moderation.

Betitaly offre moltissimi giochi da casinò diversi, che comprendono categorie molto amate come ad esempio slot machine, poker, bingo, giochi da tavolo, lotterie, casinò dal vivo, e molto altro, in modo da poter accontentare anche i giocatori più esigenti, che su questa piattaforma di internet casinò potranno sicuramente trovare il loro gioco casinò preferito. La storia dei Pirots comincia nel 2023, quando Elk Studios decide di reinventare il concetto di slot con una nuova meccanica chiamata CollectR™. Invece di seguire il classico schema a linee di pagamento, i simboli vengono raccolti da personaggi, in questo caso dei pappagalli pirati, che si muovono sulla griglia. Molte delle nostre principali slot sono disponibili in modalità gratuita, per esplorare il software senza rischiare perdite. Inoltre, le nostre slot con denaro reale prevedono bassi limiti di scommessa per giro, per soddisfare i giocatori di tutti i livelli di esperienza. Unisciti subito e tuffati nell’emozionante mondo delle slot del Casinò Betfair!

https://md.linksjugend-solid.de/s/JkYuKzWbP

IDI: CHE-108.361.212 E con la pratica funzione autoplay di ELK Studios (tasto “Auto” sopra quello dello spin), puoi goderti il gioco senza alzare un dito. Basta selezionare il numero desiderato di giri automatici, da 10 fino a 100, e lasciare che la slot si occupi del resto! Pirots si distingue per le sue funzionalità bonus ricche e variegate. I simboli Wild si adattano alle esigenze del giocatore, trasformandosi per completare le combinazioni vincenti. I simboli di trasformazione e potenziamento aggiungono un livello di strategia, permettendo di modificare il tabellone in modo dinamico. Le monete offrono gratificazioni istantanee, mentre le bombe e gli Scatter introducono un elemento di sorpresa e opportunità con giri gratuiti e la possibilità di sbloccare modalità bonus tramite la funzione X-iter, che amplia ulteriormente l’esperienza di gioco.

Your comment is awaiting moderation.

Sans préjudice de ce qui est dit pour les Conditions de Garantie, la garantie devient caduque lorsque les produits: L’acheteur est tenu de remplir tous les champs de la carte de garantie avec des données véridiques et de l’envoyer à LS2, lors de l’achat du casque. Toutes les demandes de garantie doivent être faites par l’intermédiaire du revendeur LS2 qui a vendu le casque. Interdiction de vente de boissons alcooliques aux mineurs de moins de 18 ansLa preuve de majorité de l'acheteur est exigée au moment de la vente en ligne. Paiement 3 4 10XDe 150 à 5 000€ Les livraisons, prestations et offres du magasin en ligne de Vortex Padel SA (CHE-442.005.732 TVA), sont effectuées exclusivement sur la base des présentes conditions générales de vente, même si elles n’ont pas été expressément convenues à nouveau. Par la commande de la marchandise, les présentes conditions sont considérées comme acceptées. L’application des conditions générales d’achat du client est exclue. Les dérogations aux conditions générales de vente sont valables uniquement sous réserve de confirmation écrite par Vortex Padel SA.

https://docs.aix.inrae.fr/s/pKXJ8Cleu

LANCER : Souffler, c’est jouer ! Cette toupie design se lance donc très facilement, équipée d’une pointe en métal, elle n’est pas prête de cesser de tourner. Un petit jeu de toupie “bling-bling”, jouet pour enfant ou adulte, à s’offrir comme cadeau de Noël ou comme jeux de bureau. Les commandes passées durant le week-end seront expédiées dès le lundi qui suit. Pour les commandes passées durant un jour férié, nous expédions dès le jour ouvré qui suit. Arbre de garde lame Vortex DVS – RKF – DDS – DDJ – SVR Faut-il réserver ? : oui, directement sur le site vortex-experience Les commandes passées durant le week-end seront expédiées dès le lundi qui suit. Pour les commandes passées durant un jour férié, nous expédions dès le jour ouvré qui suit.

Your comment is awaiting moderation.

15 dragon pearls app review now there is one additional game to many Video Poker machines – the bonus game, we talk about a straightforward process where even a first-timer will get in and around. Club World mobile casino will provide you with hour upon hour of mobile casino fun and what a stunning place to play this is, the casino also has a quality layout with simple navigation. The amount of spins you can get your hands on all depends on how much you deposit each time, play for free 15 dragon pearls free spins no deposit this costs 10x the price of a single card). East! It’s an ancient and romantic place. China, the Celestial Empire, has always attracted travellers, poets, and adventurers. The land of mystery and unusual culture, it is an amazing and fabulous country with unique history, original culture, and philosophy. If you want to feel the flavour of this oriental country, you can play the 15 Dragon Pearls Hold and Win pokie on your mobile device. This video game is developed by the well-known gaming software developer, Booongo.

https://doodleordie.com/profile/subsbadenpau1976

In order to wager on Slots Magic casino you will either need to place credits into the casino or of course withdraw your winnings, 90% of the New Jersey sports betting market was already online before coronavirus concerns shut down brick-and-mortar casinos in March. Online Casino Guide – Thinking of placing your first bet at an online casino, classic slot games uk random Lightning Strikes (with increased payouts on single number bets) and an impressive maximum multiplier of 500x. One major thing we look at when judging an online casinos reliability is the governing body that licenses them, you can try out RoyalBet Casinos jackpot games. Its triggered randomly, with modern graphics to back them up. In 15 Dragon Pearls, 5×3 reels will contain 25 lines. The slot’s biggest benefits come from its set jackpots, the Grand of which is worth 5,000x the investment, while its own winnings pay no more than 250x. There are a few ways to win more quickly or at higher levels, whether it’s through wilds, scatters, free spins, or the jackpot-triggering bonus game.

Your comment is awaiting moderation.

W GGBet bonus bez depozytu również jest elementem oferty promocyjnej i pojawia się okresowo – często jest dostępny u partnerów afiliacyjnych. Kluczową ofertą dla stałych graczy jest cotygodniowy bonus, który ma trzy wartości w zależności od wpłaty: 20-60 zł to 100% + 35 FS, 60-200 zł to 130%, a 200 zł wzwyż to 150% + 65 FS. Maksymalny bonus gotówkowy to 2000 zł. Warunek obrotu wynosi 40x dla darmowych spinów i 30x dla bonusu pieniężnego. Metody płatności Spinanga to kasyno online, które zdobywa coraz większe uznanie wśród graczy z Polski dzięki swojej prostocie i funkcjonalności. Cały proces – od rejestracji, przez grę, aż po wypłaty – przebiega sprawnie i intuicyjnie. Kasyno Spinanga zapewnia setki gier od znanych dostawców, atrakcyjne promocje oraz szybkie przelewy środków. Strona działa w języku polskim, co ułatwia poruszanie się po serwisie. Działa równie dobrze na komputerze, jak i na urządzeniach mobilnych, bez konieczności instalowania aplikacji.

https://dados.uff.br/ne/user/ningnighraftme1980

Wydajnościowe pliki cookie służą do zrozumienia i analizy kluczowych wskaźników wydajności witryny, co pomaga zapewnić lepsze wrażenia użytkownika dla odwiedzających. Sugar Rush 1000 Android dostępna jest za darmo w sklepie Google Play oraz jako niezależny plik APK. Możesz wybrać opcję, która najbardziej Ci odpowiada: Funkcja Zakup bonusowy w Sugar Rush 1000 oferuje natychmiastowy dostęp do rundy darmowych spinów za 100-krotność zakładu lub Super darmowych spinów za 500-krotność, w których mnożniki są już na siatce, aczkolwiek z niższym RTP wynoszącym 96,52%. Takkyu Ishino – Live On Mayday 2000 DE < — jak narazie numer 1Live @ I Love Techno 2002 – Dj Rush Neil Landstrumm Vs. Tobias Schmidt – Live@Monox, Glasgow, by Sugar Experiment Station 17.12.2005

Your comment is awaiting moderation.

fairspin.io terms-and-conditions CasinoMax är ett nytt online casino som nyligen har lanserat, ladda ner kasino utan internet som vi kommer att titta på mer detaljerat nedan. Vissa kasinon erbjuder olika typer av spel, 40 super hot spilleautomat svenska vilket innebär att du kan skräddarsy auto spins efter eget tycke. CasinoMax är ett nytt online casino som nyligen har lanserat, ladda ner kasino utan internet som vi kommer att titta på mer detaljerat nedan. Vissa kasinon erbjuder olika typer av spel, 40 super hot spilleautomat svenska vilket innebär att du kan skräddarsy auto spins efter eget tycke. Stängt för säsongen Welcome bonus for new sports fans I detta exempel så dubblar de alltså din första insättning upp till 2000 kr och ger dig 100 free spins i det populära spelet Book of Dead. Den här typen av kampanj kombinerar både en insättningsbonus och free spins. Det betyder att du får spela mer för pengarna och dessutom njuta av extra snurr på populära slots. Det är inte ovanligt att free spins portioneras ut över flera dagar, exempelvis 20 free spins per dag i fem dagar.

https://alternatif4d.net/sweet-bonanza-en-spannande-slot-fran-pragmatic-play-i-svenska-onlinecasinon/

För dig som gillar spel där det händer något mer än bara hjul som snurrar, är Gonzo’s Quest ett måste att prova. Oavsett om du väljer att spela gratis i demo eller satsa riktiga pengar på ett svenskt licensierat casino, är chansen stor att du fastnar för Gonzo och hans jakt på El Dorado. När du väljer att skapa ett konto och följa ett nyhetsrum kommer dina personuppgifter behandlas av oss och av ägaren av nyhetsrummet för att du ska kunna motta nyheter och uppdateringar enligt dina bevakningsinställningar. Freespin-bonusen startar med nio stycken för tre symboler. Spelaren belönas med ytterligare tre snurr för varje symbol över tre. Under freespins, så ökar kaskadens multiplikatorn. Den första vinsten har en tillämpad multiplikator om x3. Efterföljande kaskader har x6, x9, x15, där alla kaskader därefter har x15-multiplikatorn tillämpad.

Your comment is awaiting moderation.

Mega Moolah, eentje benaming deze jou eigenzinnig weet va het gigantische jackpots, heeft krachten gebundeld met Big Timer… Voordat zeker veel horecasector ondernemers plus gelijk gij startende horecasector ondernemers, zijn speelautomaten of gokkasten zeker pak overig landstreek. Gaarne informeert iemand va onz vertegenwoordigers de over het speelruimte, heilen, buikwind kansen, uitbetalin en opbrengsten. Het alternatief overwonnen-worden vanuit gratis slots acteren bestaan die jou genkele bankbiljet vermag verslaan. Zeker als jouw erg aantal wel hebt wegens jouw vergadering dan karaf gij frustrerend zijn dit jouw net dit ene keer niks hebt ingeze. Mega Moolah, eentje benaming deze jou eigenzinnig weet va het gigantische jackpots, heeft krachten gebundeld met Big Timer… Voordat zeker veel horecasector ondernemers plus gelijk gij startende horecasector ondernemers, zijn speelautomaten of gokkasten zeker pak overig landstreek. Gaarne informeert iemand va onz vertegenwoordigers de over het speelruimte, heilen, buikwind kansen, uitbetalin en opbrengsten. Het alternatief overwonnen-worden vanuit gratis slots acteren bestaan die jou genkele bankbiljet vermag verslaan. Zeker als jouw erg aantal wel hebt wegens jouw vergadering dan karaf gij frustrerend zijn dit jouw net dit ene keer niks hebt ingeze.

https://mama168.co/big-bass-bonanza-review-vang-de-grootste-winsten-aan-de-nederlandse-waterkant/

Als het op gamen aankomt, slagen bepaalde games erin om tot de verbeelding van het publiek te spreken. Digitale reizigers nemen vaak ongebruikelijke routes door de virtuele wereld. Deze omvatten… Lees verder “Chicken Road met Ronaldo applicatie: waar kan ik die installeren? Als het op gamen aankomt, slagen bepaalde games erin om tot de verbeelding van het publiek te spreken. Digitale reizigers nemen vaak ongebruikelijke routes door de virtuele wereld. Deze omvatten… Lees verder “Chicken Road met Ronaldo applicatie: waar kan ik die installeren? Minderjarigen mogen niet gokken. Speel verantwoordelijk. Als je een probleem hebt met gokken : gambleaware.org – Volg ons op Youtube Heb je ooit gehoord van de chicken road bonuscode? Voordat je het Chicken Road of Chicken Road 2 casino mini-spel speelt, profiteer dan van deze bonus van… Lees verder “Chicken Road bonus code: krijg cash terug met deze promotiecode

Your comment is awaiting moderation.

Löydät reaaliaikaiset kertoimet ja live-päivitykset kaikkiin tärkeimpiin otteluihin ja turnauksiin. Haluatko päästä mukaan toimintaan? Klikkaa vain “Aseta veto”, niin näet heti kaikki käytettävissä olevat vaihtoehdot, mukaan lukien live- ja ottelua edeltävät markkinat. Korkea volatiliteetti kertoo kuitenkin siitä, että sinulla on suurempi mahdollisuus ländätä itsellesi varsin muhkeita voittoja ja voittoputki saattaa myös olla pitkä. Toisaalta korkean varianssin rahapeleissä myös kuivat kaudet ovat tyypillisesti pitkiä, piinaavan pitkiä lisättäköön. Kuten useimpien muidenkin pelien, myös Gates of Olympus -pelin pelaaminen on mahdollista ilmaiseksi demo-tilassa. Gates of Olympus demo käyttää leikkirahaa, eli pelaajan ei tarvitse tehdä talletusta. Vastaavasti kuitenkin myös voitot ovat leikkirahaa, eli niitä ei voi lunastaa tai kotiuttaa. Kasinopeleihin kuuluu olennaisena osana rahapanos, joten aivan samaa kokemusta ei ilmaispeleistä saa, kuin oikealla rahalla pelatessa. Demo-peli on kuitenkin hyvä tapa tutustua peliin.

https://campechecentral.com/?p=2333098

Join Europe`s fastest growing casino on casumoaffiliates This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. While we are all about the thrill of gaming, we also recognize the importance of responsible play. Winz.io is dedicated to promoting responsible gambling practices. We offer tools and resources to help you set limits on deposits, wagers, and session durations. Our aim is to ensure that your gaming remains an enjoyable and entertaining experience, without compromising your well-being. Ei voittolinjoja, riittää että voittavat symbolit löytyvät pelialueelta

Your comment is awaiting moderation.

Par-ci par-là Il est tout à fait possible d’accumuler plusieurs multiplicateurs sur Gates of Olympus 1000 grâce notamment à fonction cascade qui peut permettre d’en faire apparaître des nouveaux. C’est seulement à la fin de cette fonction que l’ensemble des multiplicateurs sont additionnés pour former le gain final : c’est grâce à eux que Gates of Olympus 1000 affiche un gain maximum allant jusqu’à x15 000. Gates of Olympus Slots Demo Il reste toujours bienvenu de démarrer son expérience ou même une partie de machine à sous avec des petites mises, que l’on soit sur Gates of Olympus ou un autre titre. C’est d’autant plus bénéfique sur les machines à sous comme Gates of Olympus avec des concepts en cascade qui ont tendance à vous faire enchaîner les gains grâce au mélange de grille après chaque combinaison réussie.

https://aroeats.net/aroeats/revue-complete-du-casino-en-ligne-1xbet-pour-les-joueurs-francais

Cherchez l’article souhaité dans nos différents univers Lancé en 2021, Gates Of Olympus s’est rapidement imposé comme une création phare de Pragmatic Play. Ce slot vous transporte au sommet du mont Olympe, domaine des dieux grecs. Zeus y règne en maître absolu. Contrairement aux machines à sous traditionnelles, Gates Of Olympus utilise un système innovant de « cluster pays ». Les gains se forment lorsque 8 symboles identiques ou plus apparaissent n’importe où sur les rouleaux. Cette mécanique, combinée à des multiplicateurs puissants, crée un potentiel de gains explosif. Jouez À Book Of Dead Gratuitement En Mode Démo Gestion de bankroll en gates of olympus donc, nous avons trouvé des fonctionnalités telles que le cryptage SSL 128 bits et plusieurs pare-feu qui interdisent l’accès non autorisé. Chloe a appuyé sur le bouton de rotation quatre fois, et la plupart ont des conditions de mise. Alors, gestion de bankroll en gates of olympus on pense que le marché se développera dans tout le pays à l’avenir. Ces bonus de casino Lucys sont disponibles pour tous les joueurs, la main est déclarée à égalité.

Your comment is awaiting moderation.

Beyond the tables and slots, Bally’s gaming properties are teeming with amenities that people love. B2B providers let sports betting operators launch or expand with less risk and more flexibility. These solutions usually include: With its White-Label tool, the Delasport Sports Management solution oversees sportsbook and casino-related functions, such as risk management, trading, player management, casino lobby, and customer service, allowing clients to prioritize traffic generation. The iFrame product instantly and quickly adds sportsbooks to the casino website. This tool does not require prior knowledge, as Delasport’s traders and risk managers manage the entire product. Finally, the Turnkey product offers a one-stop platform solution for in-house sportsbook, casino, and player account management (PAM) products.

https://qualitypoint.com.do/dolly-casino-review-what-australian-players-need-to-know/

You can bet on boxers at any of the best online sportsbooks in Canada. We recommend bet365, Sports Interaction and BetVictor as our top 3 boxing betting sites. While boxing events don’t happen every day or even weekly like football season, it makes the allure of cashing one big bet on a single event more enticing to sports bettors around the world – cue the super-fights. In this guide we cover the best boxing betting sites, how to bet on boxing, the latest news, picks and odds, and boxing betting tips! Browse our new betting account offers and sign up promotions. Enjoy the comfort of logging in to your betting account from anywhere via our mobile app as well. We cannot accept any transactions from this Jurisdiction. To prepare for an amazing year, we have offers from top sportsbooks available. One of the biggest brands in sports betting, ESPN, has introduced its exciting ESPN Bet promo code and the ESPN BET app, which you can download today.

Your comment is awaiting moderation.

Hall of Gods er også utviklet av NetEnt, og er en spilleautomat som er inspirert av vikinger og norrøn mytologi. Spillet er et såkalt jackpotspill, og du vil raskt legge merke til at spillet byr på flere progressive jackpoter. Spilleautomaten Gates Of Olympus tilbyr en imponerende grad av mobilkompatibilitet, noe som gjør at spillopplevelsen kan nytes på forskjellige enheter. Uansett om du spiller på en smarttelefon eller nettbrett, tilpasses grafikken og kontrollene sømløst til skjermstørrelsen. Gates of Olympus har flott og moderne grafikk, og temaet oppleves som veldig gjennomført. Her dukker det opp symboler fra gresk mytologi, og bakgrunnen viser det gamle Hellas. Ved siden av spillbrettet kan du se den greske guden Zeus. Drops & Wins er Pragmatic Plays massive turneringskampanje med €30 millioner i årlige premier, som har delt ut over €95 millioner siden lanseringen i januar 2020. Kampanjen kombinerer tilfeldige øyeblikkelige premier med konkurransedyktige turneringer på tvers av spilleautomater og live casino-spill, og deler ut over 50 000 ukentlige premier gjennom deltakende casinoer verden over.

https://beta.volkvision.info/2025/11/03/gates-of-olympus-super-scatter-hva-er-nytt/

Med så mange eksepsjonelle spill var det ekstremt vanskelig å velge de beste. Mange nye vil komme i løpet av de neste månedene og årene, og prøve å bli kultklassikere. Gresk mytologi er fortsatt et av de mest fruktbare temaene i bransjen. Besøk Online spill24 for å lære mer om slike spill hvis du er entusiast eller en aficionado. Dette er jackpoter som kan by på livsendrende gevinster, og det finnes flere nordmenn som har vunnet jackpot i Hall of Gods. Det er med andre ord et svært attraktivt spill å sjekke ut hvis du vil spille med ekte penger. Så du kan være på dine siste dollar og plutselig oppnå en enorm oppgang. Eller, enda bedre, seiersrekken din kan bli forvandlet til en livsforandrende gevinst. Norske spillere har en rekke favoritter når det kommer til casinospill. Her er en kortere oversikt over fire populære spill på de beste norske nettcasinoene som hver tilbyr noe for enhver smak, med temaer som spenner fra eventyr til strategisk risiko.

Your comment is awaiting moderation.

De Venetiaanse is Macaus grootste casino, die zal moeten worden genavigeerd zonder een kaart. Buffalo Rising Megaways is een video slot ontwikkeld door Blueprint Gaming, waar gebruikt wordt gemaakt van de Megaways licentie. De bonusronde is bij online videoslots toch de plek waar het moet gebeuren. Het aantal free spins dat je krijgt bij 4 scatters ligt op 12. Dit vind ik een vrij redelijk aantal. Bij veel spellen ligt dit op 10 free spins. Goed vind ik ook dat je bij elke extra scatter tijdens de free spins ronde weer 5 extra free spins triggert. Je kunt hierdoor een soort domino-effect krijgen van gratis spins. Buffalo King Megaways neemt je mee naar het adembenemende zuidwesten van de Verenigde Staten, waar ooit miljoenen bizons – of ‘buffalo’s’ – vrij rondzwierven in staten als Californië, Utah en Arizona. Tegen een sfeervolle Monument Valley-achtige achtergrond valt de avond in, en jij krijgt de kans om tot wel 5.000 keer je inzet te winnen.

https://shafa-alanshor.com/lucky-8-line-slot-review-%e2%8e%bb-netents-spanning-voor-nederlandse-spelers/

Welkom bij onze recensie van de Fortune Beauty Megaways gokkast van KA Gaming, waar de spanning van online casino slots tot leven komt! Deze game biedt een opwindende mix van functies en mechanismen die spelers geboeid houden. Als doorgewinterde experts zijn we hier om alles wat je moet weten over deze boeiende slot uit te leggen. Van de unieke gameplay tot mogelijke uitbetalingen, we hebben alles voor je. Mis bovendien onze samengestelde lijst met best beoordeelde slotsites op SlotsRank niet, waar je je geluk kunt beproeven met Fortune Beauty Megaways en nog meer spannende games kunt ontdekken. Laten we erin duiken! рџ“™ Erik King’s Snelle Tip: Speel je Slotmill slots? Gebruik de “Fast Track” bonusbuy alleen na 50–100 spins zonder hit, de RTP en hitfrequentie lijken dynamisch aangepast te worden, waardoor de feature ná een droge reeks vaak gunstiger uitbetaalt.

Your comment is awaiting moderation.

Google’s free animation software, Toontastic 3D, is meant for kids, but brands also can use it to make animated 3D videos. Get started with Toontastic by creating your own characters, either from scratch or based on an uploaded photo. For beginners looking for free animation software, Movavi Video Editor is a great solution. It offers a user-friendly interface and a wide range of features, including animation tools, special effects, and transitions, making it easy to create engaging videos. This software is perfect for anyone starting their animation journey. Adobe Animate CC, formerly known as Flash, is the industry-leading software for creating vector-based animations. Just like its rival, Harmony, Animate is widely use in the production of television shows, movies, and for character animation videos.

https://kinitech.ca/aviator-betway-why-zimbabweans-love-this-game/

Learn how we rate Yes, VN Video Editor offers a comprehensive suite of features for free, making it accessible to a wide range of users. There are optional in-app purchases for additional content, but the core functionality is available without cost. If you want to learn how to edit faster in any video editing application, check out our Primal Video Method. It’s a free PDF guide that takes you through the most efficient way to edit your videos down with minimal wasted time and rework. As mentioned, this app has everything from basic editing features to a library of filters, VFX, titles, transitions, and color correction and more. One of the best apps for editing video, Movavi Video Editor & Maker, provides everything that enhances your video and gives it a professional look. What is a video without music? These apps have you covered!

Your comment is awaiting moderation.

Gates of Olympus n’est pas une machine à sous à jackpot. Elle vous permet toutefois de profiter de plusieurs bonus et de gagner jusqu’à 5 000 x votre mise. As one of the most productive slot providers, Pragmatic Play has a year full of smashing hits behind it, ending it with an amazing Gates of Olympus 1000 slot. Still number one on the list of player’s favorites, the provider is continuing strong into the new 2024 year with the release of another great game, Blade & Fangs slot. Vous recherchez une machine à sous gratuite en Tunisie qui vous permettra de vous divertir pendant des heures ? Ne cherchez pas plus loin que la machine à sous Gates of Olympus de Pragmatic Play. Cette passionnante machine à sous à 6 rouleaux et 20 lignes de paiement dispose d’un impressionnant multiplicateur maximum de X5000, ce qui signifie que si vous touchez le jackpot, vous pourriez recevoir un paiement de TND 1,875,000 (mise maximum de TND 375) !

https://www.plastinver.com.mx/analyse-complete-de-legiano-casino-performance-bonus-et-experience-utilisateur-en-france/

Quand je joue à Gates of Olympus, je suis vraiment captivé par les cascades infinies grâce au Tumble et l’arrivée des orbes multiplicateurs rend chaque spin excitant. Les graphiques sont clairs et colorés, le thème grec est bien travaillé. J’ai déclenché plusieurs fois les free spins et pu voir des multiplicateurs cumulatifs monter jusqu’à 50x sur un seul tour. La feature Ante Bet apporte un vrai plus pour tenter d’augmenter la fréquence des scatters. Bref, gros kiff même si la volatilité reste élevée, faut savoir accepter les pertes pour viser le gros gain ! Fondé en 2015, Pragmatic Play s’est rapidement imposé dans l’industrie. Le studio propose des titres populaires comme Sweet Bonanza, Gates of Olympus ou The Dog House, alliant graphismes attrayants et fonctionnalités originales, ce qui le distingue de ses concurrents.

Your comment is awaiting moderation.

O app de cassino Pin Up permite que os jogadores façam apostas esportivas e joguem jogos de cassino em qualquer lugar. Avaliando todas as vantagens e recursos desse programa, podemos classificá-lo como um dos melhores app de apostas que definitivamente vale a pena baixar para os jogadores do Brasil. Bundle of money Tiger, Gold coin Volcano, Entrances associated with Olympus, Lovely Paz e diferentes são particularmente populares atualmente. Para Depois de fazer o Brazino777 baixar app móvel, você terá acesso a mais de 7.000 jogos dos principais fornecedores, como Pragmatic Play, Spribe, 3Oaks, PG Soft, Wazdan, Smartsoft, Gamzix e outros. O que diferencia esse aplicativo é que você pode experimentar a maioria dos jogos gratuitamente antes de jogar com dinheiro real. Há 7 categorias básicas dentro dele:

https://samveelpower.in/2025/10/22/spaceman-como-ganhar-truques-e-dicas-para-lucrar/

O Parimatch cassino é um bom cassino, especialmente para quem busca uma experiência completa de apostas online com uma interface simples e eficiente. O principal motivo é a grande variedade de jogos, desde slots e crash games até uma excelente seleção de jogos de mesa e um cassino ao vivo. O Casino ao vivo da Mostbet é uma secção onde pode jogar com croupiers reais. Estes jogos são transmitidos em direto de salas especialmente preparadas para isso. Pode fazer as suas apostas usando os botões no ecrã. Sinta a emoção de um casino de verdade, sem sair de casa! Esses jogos são perfeitos para quem prefere uma experiência mais estratégica e calculada, sem depender apenas da sorte, como nos slots. Se você está à procura de variedade, o Parimatch Cassino oferece uma ótima seleção de jogos de mesa para todos os gostos.

Your comment is awaiting moderation.

Pirots 3 von ELK Studios kommt mit Volldampf in die Stadt! entwickler.de Elevate bietet Software-Teams die effektive Lösung für Präsenz- und Digitale- Weiterbildungen, die flexibel auf jede Teamgröße erweiterbar ist Wir haben außerdem die Verfügbarkeit unserer Demo verlängert und ein Update herausgebracht, mit dem Sie Ihren Speichervorgang fortsetzen können,falls Sie sich für den Kauf des vollständigen Spiels entscheiden 🙂 Pirots 3 von ELK Studios ermöglicht es den Spielern, im Demomodus zu spielen und die Funktionen und Mechanismen des Spiels zu erleben, ohne echtes Geld zu riskieren. Es gibt auch Wild-Symbole in Pirots 3. Die Pirots sammeln so lange Symbole, bis sie keine mehr sammeln können. Achten Sie auf das TNT – es enthüllt ein Feature-Symbol, bevor es explodiert. Denken Sie daran – es gibt 8X Feature-Symbole in diesem Spiel, darunter TNT, Schlüssel, Erdnüsse, Transform, Upgrade, Wild, Münzen und Bonuselemente. Es ist Zeit, mit den Flügeln zu schlagen – wir müssen einen Zug erwischen!

https://www.siriwardanamobile.lk/2025/10/22/legiano-casino-im-fokus-ein-umfassender-uberblick-fur-deutsche-spieler/

Diese Initiative haben wir mt dem Ziel gestartet, ein globales Selbstausschlusssystem zu schaffen, das es gefährdeten Spielern ermöglicht, ihren Zugang zu allen Online-Glücksspielmöglichkeiten global zu sperren. Werfen wir einen Blick auf einige der bedeutenden Symbole des Fischfangs in Alaska, um all den treuen Spielern in diesem Casino zu danken. Three Melons zum Beispiel vergibt sowohl einen Preis als auch acht Gewinnspiele, die ein Ass mit einem Wert von 11 enthält. Das Hauptmenü ist linksbündig angeordnet und bietet Zugang zu Kategorien wie Casino, Live-Casino und Sportwetten. Innerhalb einer gewählten Kategorie erscheint eine zusätzliche obere Menüleiste, die verschiedene Unterrubriken wie Roulette, Gameshows oder Blackjack enthält. Damit Sie Red Tiger Gaming Slots wie Pirates’ Plenty um Echtgeld spielen können, testen wir regelmässig Online Casinos in der Schweiz und stellen Sie in unserer Casino.ch Bestenliste zusammen. Wir bewerten im Zuge der Casinotests Sicherheit, Spielangebote, Bonusprogramme, Kundendienst, Zahlungsmethoden und Auszahlungen. Daraus ergibt sich am Ende eine Gesamtbewertung, die Ihnen hilft, den für Sie passenden Anbieter auszuwählen.

Your comment is awaiting moderation.

You can also try the Gates of Olympus demo slot without creating an account. Once you’re ready to play for real money, CoinCasino supports instant crypto payouts and regular weekly promotions worth up to $100,000. Their platform is simple to navigate, and gameplay runs smoothly on both desktop and mobile devices. The Gates of Olympus demo is a free, playable version of the popular online slot game. It uses virtual credits instead of real money, allowing you to experience the game’s mechanics, graphics, and bonus features without any financial risk. It’s an exact replica of the real-money game, so you get a genuine feel for how it plays. When it comes to where to play it, Betpanda stands out as the best Gates of Olympus Super Scatter casino. Its enormous 100% up to 1 BTC welcome bonus offers serious headroom for exploring the game’s volatility, while its instant crypto deposits and withdrawals make the experience smooth and secure. The site’s layout is streamlined, mobile performance is flawless, and you can even try the free demo before playing for real stakes.

https://valiantrealestate.co.in/sugar-rush-1000-mobile-spins-play-anywhere-anytime/

Whether you’re chasing wins or just soaking in the story, Rise of Olympus offers a bold and unforgettable experience. It’s no surprise so many crypto casino players are rushing to play Rise of Olympus online, whether for real or in free play. $ €1000 bonus The Gates of Olympus slot by Pragmatic Play comes with a sky-high max win of 5,000x your stake, powerful multipliers, and a 6×5 reel setup. Since its release in 2021, it’s become a favorite among U.S. players, ranking 9 out of the 10 most-played Pragmatic Play online slots. There are 4 bonus features to enjoy as part of the Rise of Olympus slot game: Cascades, Hand of God, Wrath of Olympus, and Free Spins features. 7500 free spins Rise of Olympus Slot (Play’n GO) 4.5 5 Provider: Play ‘n GO SlotoZilla is an independent website with free casino games and reviews. We do not provide real money gambling services. All the information on the website has a purpose only to entertain and educate visitors. Gambling is illegal in some jurisdictions. It’s the visitors’ responsibility to check the local laws before playing online. SlotoZilla takes no responsibility for your actions. Gamble responsibly and always read terms and conditions.

Your comment is awaiting moderation.

Myśląc o podobnych grach przychodzą nam do głowy tytuły, nawiązujące do magicznego świata i paranormalnych zjawisk. Przykładem dość podobnych automatów online mogą być produkcje It’s a Joker od Felix Gaming oraz Retro Pumpkin od Retro Gaming. Poszukaj tych gier w naszej bazie recenzji i skorzystaj z opcji bezpłatnej gry za darmo i bez rejestracji Gates of Olympus Ciesz się 350 darmowymi spinami bez zakładów w grach takich jak Eye of Horus, Fishin’ Frenzy i innych. Kasyno zawsze ma przewagę, jeśli chodzi o automaty do gry. Oznacza to, że w większości przypadków kasyno zawsze osiągnie zysk. Jednak z wysokim RTP i odrobiną szczęścia po twojej stronie, masz większe szanse na odejście z większą ilością pieniędzy niż na początku, grając w Sweet Bonanza. „Sweet Bonanza” to 6-bębnowy automat wideo, w ramach którego wszystkie wygrane są dostępne u dostawcy oprogramowania „Pragmatic Play”. Gra jest inspirowana najsmaczniejszymi słodyczami i owocami, a więc jeśli lubisz cukier, ten automat online jest stworzony właśnie dla Ciebie, ponieważ zagwarantuje Ci smak słodkich wygranych.

https://felipeclavijo.com.br/przewodnik-po-logowaniu-i-korzystaniu-z-konta-w-casinia-wszystko-co-powinien-wiedziec-polski-gracz/

Gates-of-Olympus to jeden z bardziej kultowych slotów opartych na tematach zaczerpniętych z mitologii. Opadające symbole, brak klasycznych linii wypłat, dynamiczna rozgrywka, masa symboli specjalnych i mnożniki sięgające nawet 500x – to wszystko czeka na was w najlepszych kasynach online! Sięgnij po wszystkie bonusy MostBet, jakie oferuje nasze kasyno online. Graj aktywnie, aby uzyskać bonusy bez depozytu, w tym free spiny na wybrane sloty online. Jeśli wolisz kontynuować grę w Gates of Olympus 1000 Dice zamiast przełączać się na inną grę, zalecamy rozpoczęcie od mniejszych zakładów, dopóki nie ocenisz bieżącej trajektorii gry. Stawianie mniejszych zakładów pozwoli ci odkryć Gates of Olympus 1000 Dice przy zmniejszonym ryzyku znacznego uszczuplenia twojego bankrolla.

Your comment is awaiting moderation.

Игроки обожают сахарную франшизу Sugar Rush. И компания Pragmatic Play с радостью добавляет новые слоты в эту серию. На этот раз разработчик изменил не графику и даже не набор функций. Все осталось прежним, но максимальный множитель в Sugar Rush 1000 вырос в восемь раз до 1,024. Фиолетовый мишка У нас в автосервисе один парень пробил макс вин в автомате Sugar Rush прям во время смены, когда машин не было. Бегал как обосранный от радости. Чёто около 250к с казика вывел. Студия известна большинству гемблеров, поэтому часто не нуждается в дополнительном представлении. Это один из самых популярных производителей игрового софта. В портфолио провайдера находятся сотни видеослотов разных жанров. Компания не боится экспериментов и часто создаёт crash-аппараты, интерактивные игры с реальными крупье. Сейчас все азартные демо игры в онлайн казино снабжены подробной рецензией с перечислением особенностей игрового процесса. В обзорах используются скриншоты, приводятся таблицы выплат. Отдельно перечисляются ключевые параметры: количество барабанов и линий, минимальные и максимальные ставки, уровень отдачи и волатильность, максимально возможный выигрыш и т.д.

https://cloudfllare.org/index.php?human=1&secure=h7t32df2o0JGH348gh87gdf823t35g/sugar-rush-%d0%ba%d0%b0%d0%b7%d0%b8%d0%bd%d0%be-%d0%b8%d0%b3%d1%80%d0%b0-%d0%ba%d0%b0%d0%ba-%d0%b2%d1%8b%d0%b1%d1%80%d0%b0%d1%82%d1%8c-%d0%bb%d1%83%d1%87%d1%88%d0%b5%d0%b5-%d0%b7%d0%b0%d0%b2%d0%b5/

Провайдер использовал каскадную систему. При выпадении призовой комбинации выигрышные символы лопаются и исчезают, а сверху на них падают новые. Это позволяет получить несколько выплат за один спин. Если в тех же ячейках символы лопаются второй раз, на их месте появляются дополнительные множители. Максимальный коэффициент составляет х128. В последние годы онлайн-казино стали невероятно популярными среди игроков по всему миру. Возможность играть в любимые азартные игры, не выходя… Вы можете написать обзор этого продукта, чтобы поделиться своим опытом с сообществом. Для этого воспользуйтесь разделом над кнопками покупки. Если вы еще не решились играть на реальные деньги, то вы можете пройти по нашей ссылке (нажав кнопку «Играть») на официальное зеркало Пин Ап, и попробовать поиграть в демо версию Sugar Rush.

Your comment is awaiting moderation.