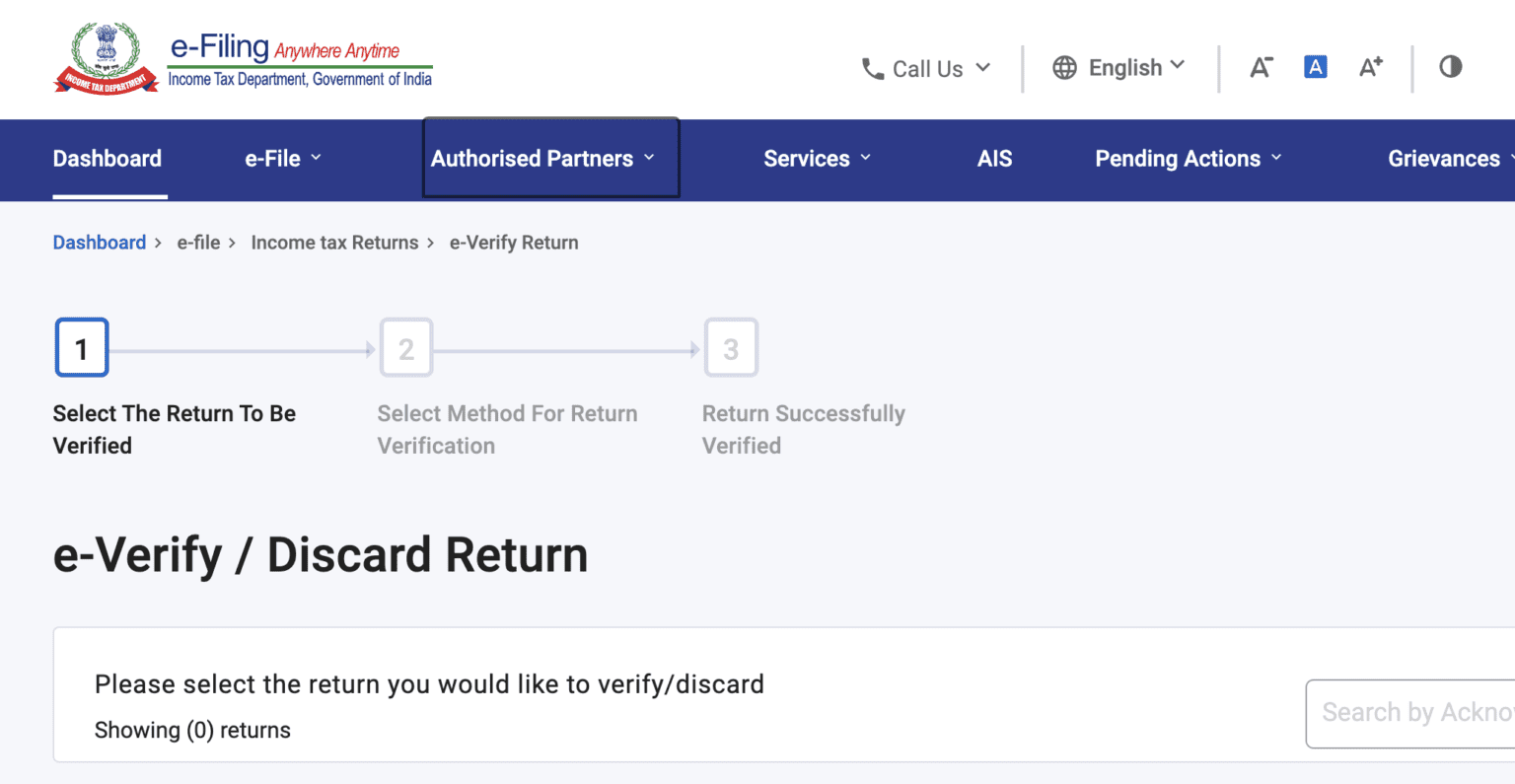

Bajaj Finance was recently instructed by the RBI to cease approving and disbursing loans under its two lending products, the Insta EMI Card and eCOM.

Following the Reserve Bank of India’s (RBI) recent decision, Bajaj Finance Ltd. temporarily stopped issuing EMI cards to new customers on Friday.

Because Bajaj Finance has not been adhering to the current criteria for digital lending, the RBI on Wednesday ordered the business to cease sanctioning and disbursing loans under its two lending products, eCOM and Insta EMI Card, immediately.

#BajajFinance pic.twitter.com/Y3HbEgiZST

— NDTV (@ndtv) November 15, 2023

The NBFC asserted that the RBI’s action won’t have a significant financial impact on it and that it will continue to provide finance to both new and existing clients at dealer locations.

“The company has put a temporary stop to issuing Existing Member Identification cards, or “EMI cards,” to new clients until the RBI’s found shortcomings have been satisfactorily addressed. In the regular course of business, the Company continues to provide financing at dealer stores to both new and existing customers. In a stock exchange filing, Bajaj Finance stated, “We further wish to inform that the above action, along with the actions communicated in this regard on November 15, 2023, will not have a material financial impact on the Company.”

“This action is necessitated due to non-adherence of the company to the extant provisions of Digital lending guidelines of the Reserve Bank of India, particularly non-issuance of Key Fact Statements to the borrowers under these two lending products and the deficiencies in the Key Fact Statements issued in respect of other digital loans sanctioned by the company,” the RBI stated in a statement.

The RBI stated that these supervisory limitations will be reevaluated upon the defects’ satisfactory correction. To safeguard borrowers’ interests, the Reserve Bank released guidelines on digital lending in August of last year. The regulatory framework focuses on the lending service providers (LSPs) and RBI Regulated Entities (REs) that work together to offer a range of authorised credit facilitation services within the digital lending ecosystem.

A working group on “digital lending, including lending through online platforms and mobile apps” (WGDL) was established by the central bank earlier in January 2021. For the second quarter that concluded on September 30, Pune-based Bajaj Finance recorded a 28% increase in its consolidated net profit to Rs 3,551 crore.

“The Company is in the process of implementing requisite actions to make good the deficiencies at the earliest, and will continue to engage with RBI to ensure compliance on all parameters,” Bajaj Finance stated on Friday.

Also read: Israel-Hamas war makes way for 1 Lakh Indians to replace palestinian workers