A GST (Goods and Services Tax) refund is a process that allows individuals and businesses to request a refund of the GST they have paid on certain goods and services. GST refunds are applicable to various scenarios, such as exports,…

A GST (Goods and Services Tax) refund is a process that allows individuals and businesses to request a refund of the GST they have paid on certain goods and services. GST refunds are applicable to various scenarios, such as exports,…

Cancellation of GST Registration Cancellation of GST Registration refers to the process by which a taxpayer ceases to be obligated to pay or collect Goods and Services Tax (GST), claim input tax credit (ITC), or file GST returns. The provisions…

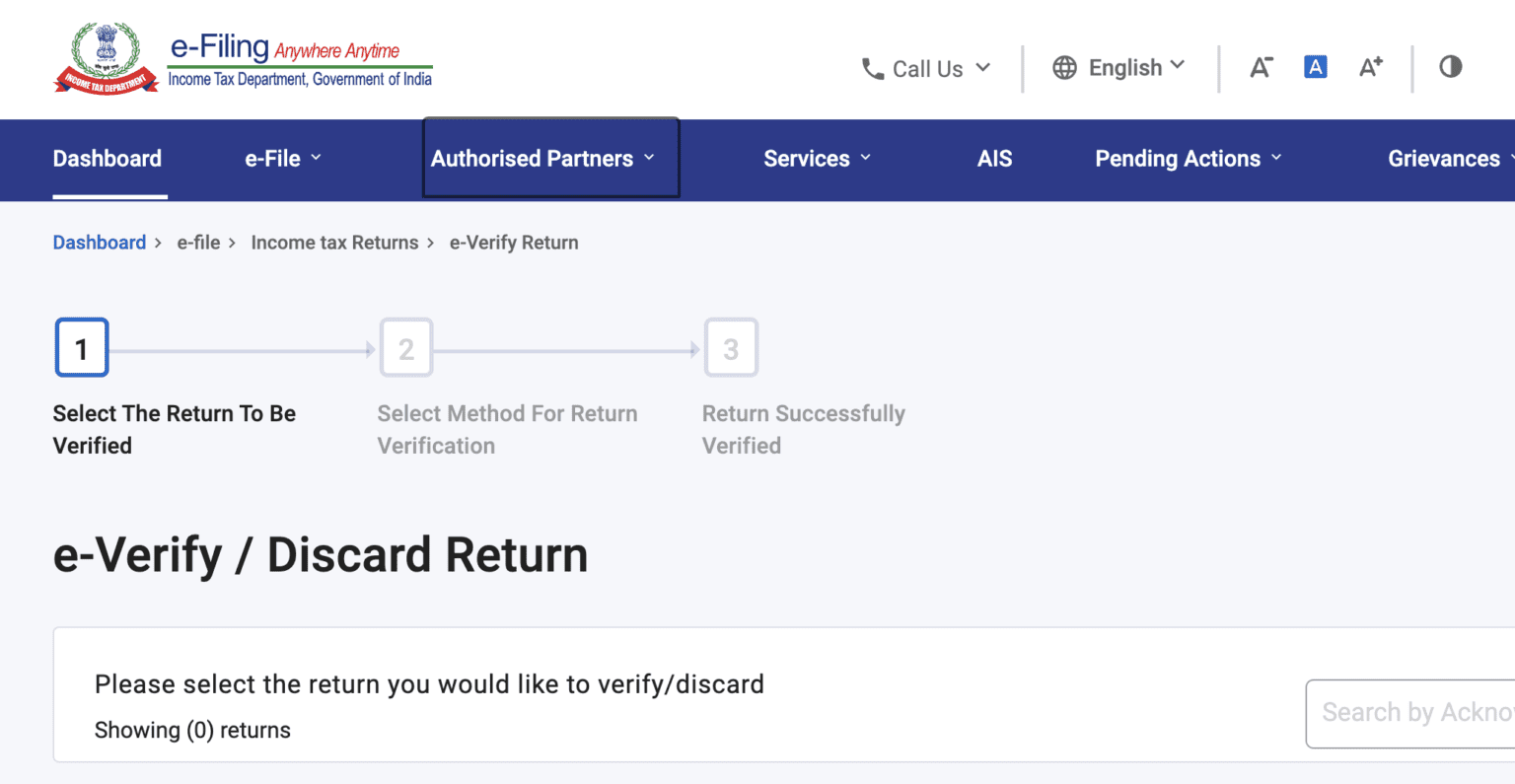

Every registered person is mandatorily required to file the GST Return within the prescribed due date as given under the Act whether on the monthly or quarterly basis. It is a document filed by the registered person mentioning the details…

Input Tax Credit (ITC): Input Tax Credit (ITC) means the amount of tax you paid on your purchase of input goods, service, capital goods, and tax paid under reverse charge. Then at the time of paying tax on your output,…

To Understand the Applicability of TDS & TCS under GST, First need to understand the Law behind it. TDS (Tax Deducted at Source and TCS (Tax Collected at Source) are two important concepts under GST. TDS (Tax deducted at source)…

E-invoicing is the process of generating invoice in a standardized electronic format with a Quick Response (QR) code and unique Invoice Reference Number (IRN). The government’s Invoice Registration Portal (IRP) is responsible for authenticating and validating these invoices. Applicability of…