Intimation of difference in liability reported in GSTR 1/IFF and GSTR 3B/3BQ

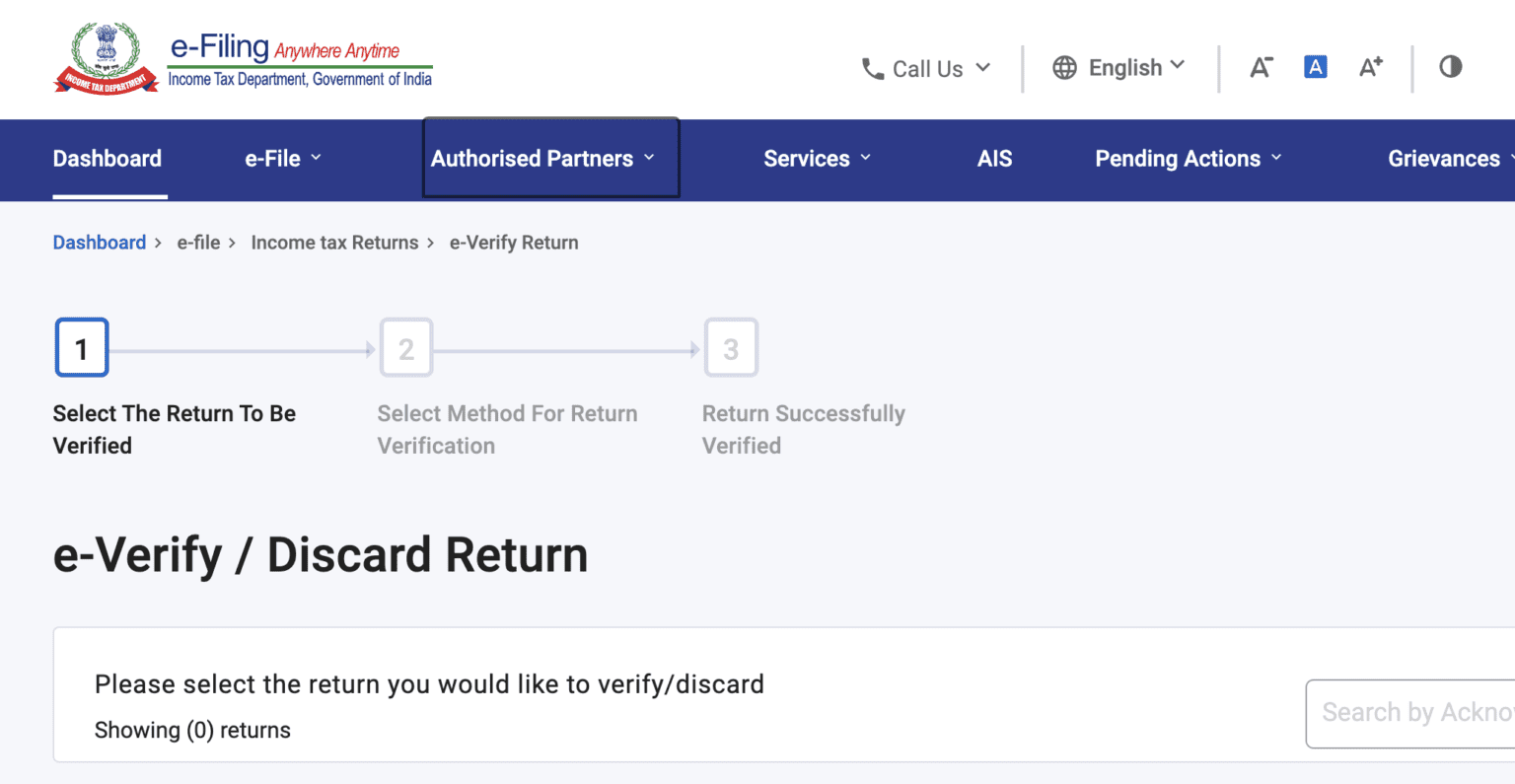

Intimation of difference in liability reported in form GSTR 1/ IFF or in form GSTR 3B of output supplies and that reported in return. The system will check the difference between the liability declared in form GSTR 1 and the liability declared in form GSTR 3B for each return period. If the liability declared in form GSTR 1/IFF will exceed the liability paid in form GSTR 3B by given limit for the return period or the percentage difference between the liability declared in GSTR 1/IFF exceeds the given percentage threshold limit from the liability paid in form GSTR 3B for the return period, then an intimation is sent to you.

If you receive an intimation in form DRC-01B for difference between the liability in GSTR 1/IFF and that liability paid in form GSTR 3B beyond the given threshold limit, then you need to submit your reply in form DRC-01B, part B to provide the necessary details and reconcile the difference between your liability declared in form GSTR 1/IFF and in Form GSTR 3B. In accordance with sub-rule (1) of rule 88C, you are requested to either pay the differential tax liability, along with interest under section 50, through form DRC-03 or furnish the details in part B of Form DRC-01B, and furnish the reply in Part B of form GST DRC-01B incorporating reasons in respect of that part of the differential tax liability that has remained unpaid, within a period of seven days. It may be noted that where any amount remain unpaid within a period of seven days and where no explanation or reason is filed by the taxpayer is not found to be acceptable by the proper officer, the said amount shall be recoverable in accordance with the provision of section 79 of the act.

FAQ's

You need to submit your reply in form DRC-01B, part B to provide the necessary details and reconcile the difference between your liabilities declared in form GSTR 1/IFF and in Form GSTR 3B.

It is applicable on regular taxpayers (including SEZ units and SEZ developers), casual taxpayers, and taxpayers opting composition schemes.

The taxpayer needs to reply in form DRC-01B part B within seven days.